Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases...Read more

Personal injury protection (PIP) is a type of car insurance coverage that pays for medical expenses and lost wages if you or your passengers are injured in a car accident. But what exactly does PIP cover? Understanding the ins and outs of this coverage can help you make informed decisions about your car insurance policy.

In this article, we’ll break down the specific types of expenses that PIP can pay for, as well as the limitations of this coverage. Whether you’re shopping for car insurance or simply trying to understand your existing policy, this guide will provide valuable insights into personal injury protection.

**What Does Personal Injury Protection (PIP) Pay for?**

Personal Injury Protection (PIP) is a type of insurance coverage that pays for medical expenses and lost wages in case of an injury resulting from a car accident. PIP is mandatory in some states, while in others it is optional. In this article, we will discuss what PIP pays for and how it can benefit you.

**1. Medical Expenses**

One of the primary benefits of PIP is that it pays for medical expenses related to an accident, regardless of who was at fault. This includes hospital bills, doctor visits, diagnostic tests, and prescription drugs. PIP coverage can help you get the medical care you need without worrying about the cost.

In addition, PIP can also cover medical expenses that are not covered by your health insurance. For example, if your health insurance has a high deductible or co-pay, PIP can cover those costs.

**2. Lost Wages**

If you are unable to work due to an injury sustained in a car accident, PIP can cover your lost wages. This includes both current and future income that you may lose as a result of your injury. PIP can help you stay financially stable while you recover from your injuries.

**3. Rehabilitation Costs**

If you require rehabilitation or physical therapy after an accident, PIP can cover those costs. This can include visits to a physical therapist, chiropractor, or other healthcare professional. Rehabilitation can help you recover from your injuries more quickly and get back to your normal activities.

**4. Funeral Expenses**

In the unfortunate event that a car accident results in a fatality, PIP can also cover funeral and burial expenses. This can help ease the financial burden on the family of the deceased during a difficult time.

**5. Legal Costs**

If you are involved in a lawsuit related to a car accident, PIP can also cover some legal costs. This can include attorney fees, court costs, and other expenses related to the lawsuit. PIP can help you get the legal representation you need without worrying about the cost.

**6. Benefits of PIP vs. Other Insurance Types**

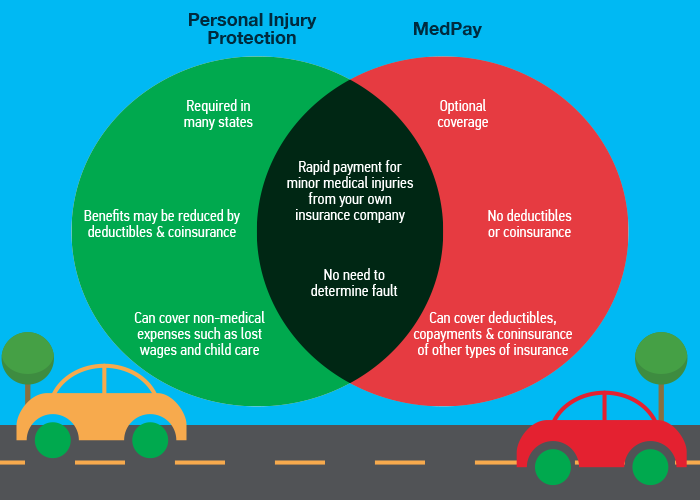

PIP is different from other types of insurance coverage, such as liability insurance. Liability insurance only covers damages that you may cause to other people or property in a car accident. PIP, on the other hand, covers your own medical expenses and lost wages, regardless of who was at fault.

In addition, PIP is a no-fault insurance, meaning that you can receive benefits even if you were responsible for the accident. This can be especially beneficial if you live in a state with a no-fault insurance system.

**7. How to File a PIP Claim**

If you are involved in a car accident and have PIP coverage, you will need to file a claim to receive benefits. The process for filing a claim can vary depending on your insurance company, but generally, you will need to provide documentation of your medical expenses and lost wages.

It is important to file your PIP claim as soon as possible after the accident to ensure that you receive benefits in a timely manner.

**8. PIP Coverage Limits**

Like other types of insurance coverage, PIP has coverage limits. These limits vary depending on the insurance company and the state in which you live. You should review your policy to understand what your PIP coverage limits are and what expenses are covered.

**9. PIP and Health Insurance**

If you have both PIP and health insurance, you may wonder which one to use to cover your medical expenses. In general, you should use your PIP coverage first, as it is designed specifically to cover medical expenses related to a car accident.

If your PIP coverage is exhausted or does not cover all of your medical expenses, you can then use your health insurance to cover the remaining costs.

**10. Conclusion**

Personal Injury Protection (PIP) is an important type of insurance coverage that can help you pay for medical expenses and lost wages after a car accident. PIP coverage can also cover rehabilitation costs, funeral expenses, and legal costs related to a lawsuit.

PIP is different from other types of insurance coverage, such as liability insurance, and is a no-fault insurance. If you are involved in a car accident, it is important to file your PIP claim as soon as possible to ensure that you receive benefits in a timely manner.

Contents

Frequently Asked Questions

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of car insurance coverage that pays for medical expenses and lost wages in case of an accident, regardless of who is at fault for the accident. It is also known as no-fault insurance.

PIP can cover a variety of expenses, including hospital bills, ambulance fees, rehabilitation costs, and lost income. It is typically required in no-fault states, where each driver’s insurance company is responsible for paying their own policyholder’s expenses.

What Does PIP Pay for?

PIP pays for a variety of expenses related to a car accident, including medical expenses, lost wages, and other related costs. Medical expenses may include hospital bills, doctor’s appointments, medical procedures, and medication costs. Additionally, PIP may cover expenses related to rehabilitation, such as physical therapy or chiropractic care.

Lost wages may also be covered by PIP if the injured party is unable to work due to their injuries. PIP may pay for a portion of the injured person’s income that they would have earned if they had not been injured. Other related costs that may be covered by PIP include travel expenses to medical appointments and in-home nursing care.

Is PIP Required in Every State?

No, PIP is not required in every state. PIP is required in some states that have no-fault insurance laws, such as Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Oregon, Pennsylvania, and Utah. In other states, drivers may be required to carry other types of insurance coverage, such as liability insurance or uninsured motorist coverage.

However, even in states where PIP is not required, it may still be a good idea to consider purchasing it as part of your car insurance policy. PIP can provide valuable protection in case of an accident, regardless of who is at fault.

How Much PIP Coverage Do I Need?

The amount of PIP coverage you need may depend on a variety of factors, including your state’s insurance requirements, your personal financial situation, and your health insurance coverage. Some states may require a minimum amount of PIP coverage, while others may allow you to choose the amount of coverage you want to purchase.

If you have health insurance that covers medical expenses related to car accidents, you may not need as much PIP coverage. However, if you do not have health insurance or have limited coverage, you may want to consider purchasing a higher amount of PIP coverage to ensure that you are fully protected.

Can I Sue for Damages if I Have PIP Coverage?

In most cases, if you have PIP coverage, you are not able to sue for damages related to a car accident. PIP coverage is designed to provide quick and efficient payment for medical expenses and lost wages, without the need for a lengthy legal process. However, there are some exceptions to this rule.

If your injuries are severe, or if your medical expenses and lost wages exceed your PIP coverage limits, you may be able to file a lawsuit against the at-fault driver. Additionally, if the other driver was under the influence of drugs or alcohol, or was driving recklessly, you may also be able to pursue legal action.

What is Personal Injury Protection (PIP)?

In conclusion, Personal Injury Protection (PIP) is a type of insurance coverage that pays for medical expenses, lost wages, and other related expenses in the event of an accident. PIP is typically required in no-fault states, but it can also be added as an optional coverage in other states.

When it comes to what PIP pays for, the list is extensive. It can cover medical expenses such as hospital bills, doctor visits, and physical therapy. It can also cover lost wages due to missed work, as well as funeral expenses and childcare costs. In some cases, PIP may even cover expenses related to mental health treatment or rehabilitation.

Overall, having PIP coverage can provide peace of mind in the event of an accident. It can help alleviate the financial burden of medical bills and lost wages, allowing you to focus on your recovery. If you’re unsure about whether or not you need PIP coverage, speak with your insurance provider to discuss your options and make an informed decision.

Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases from minor injuries to devastating accidents, earning him a sterling reputation as a trusted and passionate advocate for justice. Brenton's unwavering dedication to his clients has cemented his position as a sought-after personal injury attorney.

- Latest Posts by Brenton Armour

-

Can You Get A Misdiagnosis Cataracts?

- -

South Carolina Dog Bite Laws?

- -

Iowa Dog Bite Laws?

- All Posts