Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases...Read more

Every year, thousands of people are injured in automobile accidents. Injuries can range from minor cuts and bruises to more serious injuries that require extensive medical treatment. If you’ve been in an accident, you may be wondering what your insurance covers. Specifically, you may be interested in learning about personal injury protection (PIP) coverage and what it covers.

Personal injury protection (PIP) coverage is an optional addition to your auto insurance policy. It provides coverage for medical expenses, lost wages, and other expenses related to injuries sustained in an accident. In this article, we’ll provide an overview of what PIP coverage is and what it typically covers, so you can determine whether it’s a good option for you.

What Does Personal Injury Protection Cover?

Personal Injury Protection (PIP) is a type of insurance coverage that provides benefits for medical expenses, lost wages, and other related costs resulting from a car accident. PIP covers the policyholder, passengers, and pedestrians involved in an accident, regardless of who was at fault. In this article, we’ll take a closer look at what PIP covers and how it works.

Medical Expenses

PIP covers medical expenses related to a car accident, including hospitalization, surgery, diagnostic tests, and rehabilitation. PIP pays for these expenses regardless of who caused the accident. If you have health insurance, PIP will pay for medical expenses that exceed your health insurance coverage limits.

PIP also covers medical expenses for passengers in your car and pedestrians who are injured in an accident involving your car. If you’re a passenger in someone else’s car and get injured in an accident, you can claim PIP benefits from the driver’s insurance policy.

Lost Wages

If you can’t work due to injuries sustained in a car accident, PIP will cover your lost wages up to a certain limit. This benefit is designed to help you maintain your income while you recover from your injuries. Lost wages coverage applies to the policyholder and any passengers injured in the accident.

Funeral Expenses

If someone dies in a car accident, PIP will cover the funeral expenses up to a certain limit. This benefit is designed to help the family of the deceased cope with the financial burden of funeral expenses.

Child Care Expenses

If you have children and are injured in a car accident, PIP will cover child care expenses up to a certain limit. This benefit is designed to help you pay for child care while you recover from your injuries.

Rehabilitation Expenses

If you require rehabilitation after a car accident, PIP will cover the costs associated with physical therapy and other types of rehabilitation. This benefit is designed to help you recover from your injuries and return to your normal activities as soon as possible.

Death Benefits

If someone dies in a car accident, PIP will provide death benefits to the family of the deceased. The amount of the death benefit varies depending on the policy and the state.

Benefits of PIP

One of the main benefits of PIP is that it provides coverage regardless of who was at fault in the accident. This means that you can receive benefits even if you caused the accident. PIP also provides coverage for passengers and pedestrians, which can be particularly helpful if you’re involved in an accident where multiple people are injured.

PIP Vs. Health Insurance

While health insurance covers medical expenses, it may not cover all the costs associated with a car accident. PIP is designed specifically to cover the costs associated with car accidents, including lost wages, child care, and rehabilitation. If you have health insurance and PIP, PIP will cover the expenses that exceed your health insurance coverage limits.

PIP Vs. Liability Insurance

Liability insurance only covers the costs associated with injuries sustained by other people in an accident that you caused. PIP provides coverage for your own injuries, as well as the injuries of your passengers and pedestrians. If you’re involved in an accident that you caused, PIP will provide benefits regardless of who was at fault.

How PIP Works

If you’re involved in a car accident and have PIP coverage, you’ll need to file a claim with your insurance company. Your insurance company will review the claim and determine the benefits you’re entitled to receive. You may need to provide documentation of your medical expenses, lost wages, and other related costs.

Conclusion

Personal Injury Protection (PIP) is a type of insurance coverage that provides benefits for medical expenses, lost wages, and other related costs resulting from a car accident. PIP covers the policyholder, passengers, and pedestrians involved in an accident, regardless of who was at fault. PIP provides coverage for a variety of expenses, including medical expenses, lost wages, child care, and rehabilitation. If you’re involved in a car accident, PIP can help you cope with the financial burden of your injuries and get back on your feet as soon as possible.

Contents

- Frequently Asked Questions

- What exactly does Personal Injury Protection cover?

- Does Personal Injury Protection cover all medical expenses?

- Does Personal Injury Protection cover lost wages?

- What is the difference between PIP insurance and medical payments coverage?

- Is Personal Injury Protection worth the extra cost?

- What Is Personal Injury Protection Insurance And What Does It Cover?

- Can You Get A Misdiagnosis Cataracts?

- South Carolina Dog Bite Laws?

- Iowa Dog Bite Laws?

Frequently Asked Questions

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages in case of an accident. If you are not sure what PIP covers or how it can benefit you, then read on to find the answers to the most frequently asked questions.

What exactly does Personal Injury Protection cover?

Personal Injury Protection or PIP is a type of no-fault insurance that covers medical expenses, lost wages, and other related expenses if you are injured in a car accident. PIP insurance can also cover expenses for rehabilitation, funeral costs, and even household services if you are unable to perform them due to your injuries.

PIP insurance is mandatory in some states, while in others, it is optional. It is important to check with your insurance provider to know what your policy covers and how much coverage you can get.

Does Personal Injury Protection cover all medical expenses?

Personal Injury Protection insurance usually covers medical expenses up to a certain limit. This limit can vary depending on the state you live in and the type of insurance policy you have. Some states have a “no-fault” system, which means that your PIP insurance will cover your medical expenses regardless of who caused the accident. However, in other states, PIP insurance may only cover a portion of your medical expenses, and you may need to seek compensation from the at-fault driver’s insurance company for the rest of the expenses.

It is important to note that PIP insurance does not cover property damage or liability claims. Therefore, it is recommended that you also have liability insurance to protect yourself in case you are found responsible for causing an accident.

Does Personal Injury Protection cover lost wages?

Yes, Personal Injury Protection insurance can cover lost wages if you are unable to work due to your injuries. The amount of coverage for lost wages can vary depending on your policy and state laws. Some policies may cover up to 80% of your lost wages, while others may have a dollar limit on the amount of coverage.

It is important to note that you may need to provide proof of your lost wages to your insurance company, such as a doctor’s note or a letter from your employer. Additionally, some policies may have a waiting period before they start covering lost wages, so it is important to check the terms of your policy with your insurance provider.

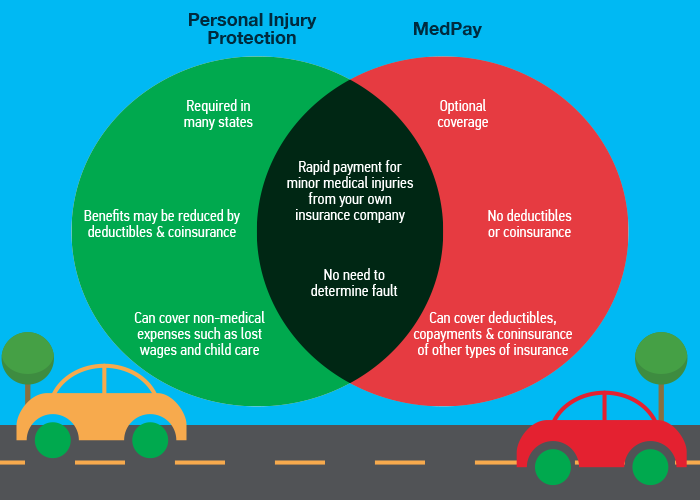

What is the difference between PIP insurance and medical payments coverage?

PIP insurance and medical payments coverage are both types of car insurance that cover medical expenses. However, there are some key differences between the two. PIP insurance usually covers a broader range of expenses, such as lost wages, rehabilitation, and household services, while medical payments coverage typically only covers medical expenses.

Another difference is that PIP insurance is mandatory in some states, while medical payments coverage is optional. Additionally, PIP insurance usually has higher coverage limits than medical payments coverage. It is important to check with your insurance provider to know what type of coverage is best for you.

Is Personal Injury Protection worth the extra cost?

Whether or not Personal Injury Protection is worth the extra cost depends on your personal circumstances and the laws in your state. If you live in a state where PIP insurance is mandatory, then you do not have a choice but to purchase it. However, if you live in a state where PIP insurance is optional, then you need to weigh the cost of the insurance against the potential benefits.

If you have good health insurance and disability coverage, then you may not need PIP insurance. However, if you do not have these types of coverage, then PIP insurance can provide much-needed financial protection in case of an accident. It is important to consult with your insurance provider to know what type of coverage is best for you and your budget.

What Is Personal Injury Protection Insurance And What Does It Cover?

In conclusion, personal injury protection (PIP) is an essential type of insurance coverage that helps cover medical expenses and lost wages in case of an accident. PIP coverage can be purchased as part of an auto insurance policy, and it usually covers expenses regardless of who is at fault for the accident.

By having PIP coverage, you can have peace of mind knowing that you and your passengers are protected in the event of an accident. You can focus on your recovery instead of worrying about medical bills and lost wages.

It is important to note that PIP coverage varies from state to state, so it is essential to check your local laws and regulations to know what is covered in your policy. With the right PIP coverage, you can be prepared for the unexpected and have the financial protection you need to recover from an accident.

Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases from minor injuries to devastating accidents, earning him a sterling reputation as a trusted and passionate advocate for justice. Brenton's unwavering dedication to his clients has cemented his position as a sought-after personal injury attorney.

- Latest Posts by Brenton Armour

-

Can You Get A Misdiagnosis Cataracts?

- -

South Carolina Dog Bite Laws?

- -

Iowa Dog Bite Laws?

- All Posts