Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases...Read more

If you live in Mississippi, you may be wondering if you are required to have personal injury protection (PIP) as part of your car insurance policy. While some states mandate PIP coverage, Mississippi is not one of them. However, it’s still important to understand what PIP is and how it can protect you in the event of an accident.

In this article, we’ll explore the ins and outs of PIP coverage, including what it covers, why it’s important, and whether or not it’s worth adding to your insurance policy. By the end, you’ll have a better understanding of PIP and be better equipped to make informed decisions regarding your car insurance coverage.

Contents

- Is Personal Injury Protection Required in Mississippi?

- Frequently Asked Questions

- Is Personal Injury Protection Required in Mississippi?

- What Does Personal Injury Protection Cover in Mississippi?

- How Much Personal Injury Protection Coverage Should I Get in Mississippi?

- What Happens if I Don’t Have Personal Injury Protection in Mississippi?

- Can I Use Personal Injury Protection to Sue in Mississippi?

- What is Personal Injury Protection (PIP)?

- Can You Get A Misdiagnosis Cataracts?

- South Carolina Dog Bite Laws?

- Iowa Dog Bite Laws?

Is Personal Injury Protection Required in Mississippi?

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of insurance coverage that pays for medical expenses and other damages resulting from a car accident. PIP is also known as no-fault insurance because it pays regardless of who is at fault for the accident. This type of coverage is required in some states, but not all.

Is PIP Required in Mississippi?

No, PIP is not required in Mississippi. However, Mississippi law does require drivers to carry liability insurance, which covers damages to other people’s property and injuries to other people in an accident that you cause.

Benefits of PIP

While PIP is not required in Mississippi, it can be beneficial for drivers to carry this type of coverage. PIP can help cover medical expenses, lost wages, and other damages that may not be covered by liability insurance. PIP can also provide coverage for passengers in your vehicle, regardless of who is at fault for the accident.

How Does PIP Work?

In states where PIP is required, drivers are typically required to carry a minimum amount of coverage. In Mississippi, PIP is not required, so drivers can choose whether or not to add this coverage to their insurance policy.

If you choose to add PIP coverage to your policy, it will typically pay for medical expenses and other damages up to the policy limit. The policy limit is the maximum amount that the insurance company will pay for a covered claim.

PIP vs. Liability Insurance

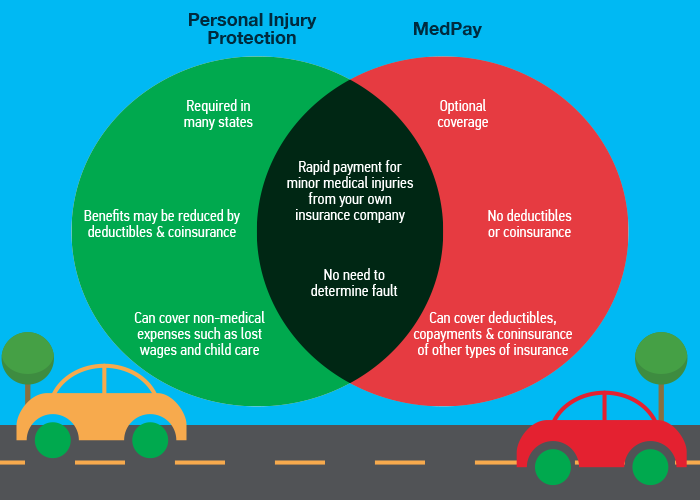

While liability insurance is required in Mississippi, it only covers damages and injuries that you cause to others in an accident. PIP, on the other hand, covers medical expenses and other damages for you and your passengers, regardless of who is at fault for the accident.

If you are involved in an accident that is not your fault, the other driver’s liability insurance should cover your damages and injuries. However, if the other driver is uninsured or underinsured, PIP can help cover your expenses.

Cost of PIP

The cost of PIP coverage can vary depending on the insurance company, your driving record, and other factors. If you are considering adding PIP coverage to your policy, it is important to shop around and compare quotes from multiple insurance companies.

Alternatives to PIP

If you decide not to carry PIP coverage, there are other types of insurance that can help cover medical expenses and other damages. For example, medical payments coverage can help cover medical expenses for you and your passengers, regardless of who is at fault for the accident.

Conclusion

While PIP is not required in Mississippi, it can be a beneficial type of coverage for drivers to carry. PIP can help cover medical expenses and other damages that may not be covered by liability insurance. If you are considering adding PIP coverage to your policy, it is important to shop around and compare quotes from multiple insurance companies.

Frequently Asked Questions

Is Personal Injury Protection Required in Mississippi?

Yes, Personal Injury Protection (PIP) is required in Mississippi. PIP is a coverage that pays for medical expenses, lost wages, and other related expenses if you are injured in an accident, regardless of who is at fault. Mississippi law requires that all drivers carry PIP coverage with a minimum limit of $1,000.

PIP coverage is also known as no-fault insurance. This means that regardless of who caused the accident, your PIP coverage will pay for your medical expenses and other related expenses. It is important to note that PIP coverage is not a substitute for liability insurance, which is also required in Mississippi. Liability insurance pays for damages that you may cause to other people or their property in an accident.

What Does Personal Injury Protection Cover in Mississippi?

Personal Injury Protection (PIP) coverage in Mississippi covers medical expenses, lost wages, and other related expenses if you are injured in an accident. Medical expenses can include hospital bills, doctor visits, and other medical treatments. Lost wages can include the income you would have earned if you were not injured in the accident. Other related expenses can include transportation costs, childcare expenses, and other expenses related to your injury.

PIP coverage is a no-fault insurance, which means that regardless of who caused the accident, your PIP coverage will pay for your medical expenses and other related expenses. However, it is important to note that PIP coverage has limits and may not cover all of your expenses. It is also important to have liability insurance in addition to PIP coverage in Mississippi.

How Much Personal Injury Protection Coverage Should I Get in Mississippi?

In Mississippi, the minimum Personal Injury Protection (PIP) coverage required by law is $1,000. However, it is recommended that you get more coverage to protect yourself in case of an accident. The amount of PIP coverage you need depends on your individual circumstances, such as your income, health insurance, and family situation.

If you have a high income and do not have health insurance, you may want to consider getting higher PIP coverage to protect yourself in case of an accident. If you have a family and dependents, you may also want to consider getting higher PIP coverage to protect them in case of an accident. It is important to shop around and compare different PIP coverage options to find the best coverage for your needs.

What Happens if I Don’t Have Personal Injury Protection in Mississippi?

If you do not have Personal Injury Protection (PIP) coverage in Mississippi, you may be fined or face other penalties. Mississippi law requires that all drivers carry PIP coverage with a minimum limit of $1,000. If you are caught driving without PIP coverage, you may be fined up to $500 and your driver’s license may be suspended.

In addition to the legal penalties, not having PIP coverage can also leave you vulnerable to financial problems in case of an accident. Without PIP coverage, you may have to pay for your medical expenses and other related expenses out of pocket, which can be expensive. It is important to have PIP coverage to protect yourself and your family in case of an accident.

Can I Use Personal Injury Protection to Sue in Mississippi?

No, you cannot use Personal Injury Protection (PIP) to sue in Mississippi. PIP is a no-fault insurance, which means that regardless of who caused the accident, your PIP coverage will pay for your medical expenses and other related expenses. However, PIP coverage does not cover damages for pain and suffering or other non-economic damages.

If you want to sue for damages in Mississippi, you will need to file a personal injury lawsuit. To file a personal injury lawsuit, you will need to prove that the other driver was at fault for the accident and that you suffered damages as a result of the accident. It is important to consult with an experienced personal injury attorney in Mississippi to understand your legal rights and options.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection, or PIP, is not required in Mississippi, but it can provide invaluable benefits in the event of an accident. While it is not mandatory, it is highly recommended that drivers consider adding PIP coverage to their auto insurance policy.

PIP can help cover medical expenses, lost wages, and other related costs, regardless of who is at fault for the accident. This can provide peace of mind and financial protection to drivers and their passengers.

Overall, it is important for drivers in Mississippi to carefully consider their auto insurance coverage and weigh the potential benefits of adding PIP. While it may not be required, it can provide valuable protection in the event of an accident.

Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases from minor injuries to devastating accidents, earning him a sterling reputation as a trusted and passionate advocate for justice. Brenton's unwavering dedication to his clients has cemented his position as a sought-after personal injury attorney.

- Latest Posts by Brenton Armour

-

Can You Get A Misdiagnosis Cataracts?

- -

South Carolina Dog Bite Laws?

- -

Iowa Dog Bite Laws?

- All Posts