Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases...Read more

Maine is a beautiful state with stunning landscapes, historic towns, and a vibrant local culture. But amidst all the beauty and charm, accidents can happen. If you’re involved in a car accident in Maine, you may be wondering whether personal injury protection (PIP) is required.

Personal injury protection (PIP) is a type of car insurance that covers medical expenses and lost wages in the event of an accident. In Maine, PIP is a mandatory component of all car insurance policies. This means that if you want to drive legally in the state, you’ll need to have PIP coverage. But what exactly does this mean for you as a driver? Let’s take a closer look.

Yes, Personal Injury Protection (PIP) is mandatory in Maine. All motor vehicle insurance policies issued or renewed in the state must include a minimum of $2,000 in PIP coverage. PIP covers medical expenses, lost wages, and other related expenses for the driver and passengers injured in a car accident, regardless of fault. Failure to carry PIP coverage can result in fines and license suspensions.

Contents

- Is Personal Injury Protection Required in Maine?

- Frequently Asked Questions

- 1. Is Personal Injury Protection required in Maine?

- 2. What happens if I don’t have Personal Injury Protection in Maine?

- 3. What does Personal Injury Protection cover in Maine?

- 4. Can I waive Personal Injury Protection in Maine?

- 5. How much Personal Injury Protection should I carry in Maine?

- What is Personal Injury Protection (PIP)?

- Can You Get A Misdiagnosis Cataracts?

- South Carolina Dog Bite Laws?

- Iowa Dog Bite Laws?

Is Personal Injury Protection Required in Maine?

Personal injury protection, or PIP, is a type of auto insurance coverage that pays for medical expenses and lost wages in the event of an accident. While PIP is mandatory in some states, Maine is not one of them. However, just because PIP isn’t required by law in Maine doesn’t mean it’s not a good idea to have. In this article, we’ll explore the ins and outs of PIP in Maine and help you decide if it’s right for you.

What is Personal Injury Protection?

Personal injury protection is a type of auto insurance coverage that pays for medical expenses and lost wages if you or your passengers are injured in a car accident, regardless of who was at fault. PIP also covers expenses related to rehabilitation, funeral costs, and in some cases, childcare expenses. PIP is often referred to as “no-fault” coverage because it pays out regardless of who caused the accident.

PIP is designed to help drivers and passengers get the medical care they need after an accident without having to worry about who was at fault. In many cases, PIP can be a valuable safety net for drivers who may not have adequate health insurance or disability coverage.

Is Personal Injury Protection Required in Maine?

Unlike some other states, Maine does not require drivers to carry personal injury protection. However, drivers in Maine are required to carry liability insurance, which covers the cost of damages and injuries you may cause to others in an accident. Maine also requires uninsured motorist coverage, which pays for your medical expenses if you are hit by a driver who does not have insurance.

While PIP is not mandatory in Maine, it is still a good idea to consider adding it to your auto insurance policy. PIP can provide valuable protection in the event of an accident, and it may be more affordable than you think.

The Benefits of Personal Injury Protection

There are several benefits to having personal injury protection as part of your auto insurance policy. The most obvious benefit is that PIP pays for medical expenses and lost wages if you or your passengers are injured in an accident. This can be especially valuable if you have high deductibles or limited health insurance coverage.

Another benefit of PIP is that it can help cover expenses related to rehabilitation and other medical care. If you or a loved one is seriously injured in an accident, these expenses can quickly add up. PIP can help ease the financial burden of recovery and give you peace of mind knowing that you have coverage for these expenses.

Personal Injury Protection vs. Medical Payments Coverage

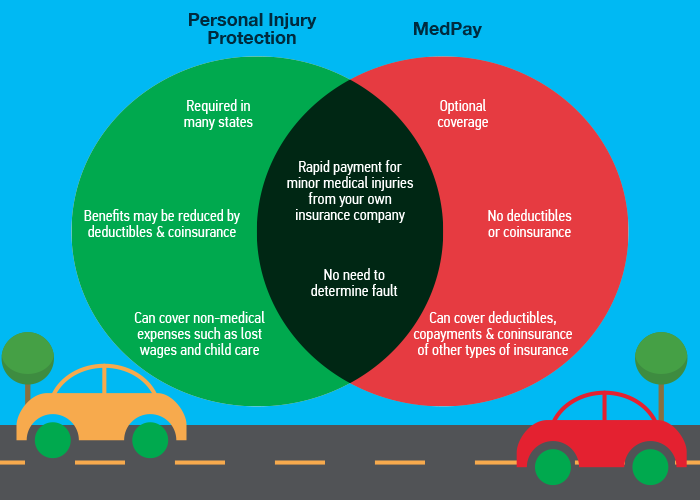

Medical payments coverage, or MedPay, is another type of auto insurance coverage that pays for medical expenses related to an accident. However, unlike PIP, MedPay does not cover lost wages or other expenses related to rehabilitation or childcare.

One advantage of MedPay is that it often has lower premiums than PIP. However, if you or your passengers are seriously injured in an accident, MedPay may not provide enough coverage to meet your needs. PIP, on the other hand, provides more comprehensive coverage and can help ensure that you have the financial resources you need to recover from an accident.

Conclusion

While personal injury protection is not required by law in Maine, it can be a valuable addition to your auto insurance policy. PIP provides coverage for medical expenses, lost wages, and other expenses related to an accident, regardless of who was at fault. If you’re considering adding PIP to your policy, be sure to compare quotes from multiple insurance providers to find the best coverage at an affordable price.

Frequently Asked Questions

Personal Injury Protection (PIP) is a type of car insurance coverage that pays for medical expenses and lost wages in case of an accident. If you are a driver in Maine, it’s important to understand the state’s requirements for PIP coverage. Here are some common questions and answers about PIP in Maine.

1. Is Personal Injury Protection required in Maine?

Yes, PIP is required in Maine. Drivers are required to carry a minimum of $2,000 in PIP coverage. This coverage applies regardless of who is at fault in an accident.

PIP coverage can also be extended to cover additional expenses, such as funeral costs and rehabilitation expenses. It’s important to note that PIP coverage is no-fault coverage, which means that it applies regardless of who caused the accident.

2. What happens if I don’t have Personal Injury Protection in Maine?

If you don’t have PIP coverage in Maine, you may be subject to fines and penalties. Additionally, if you are involved in an accident and don’t have PIP coverage, you may be responsible for paying for your own medical expenses, lost wages, and other related costs.

In some cases, you may also be sued by other drivers or passengers involved in the accident for their medical expenses and other damages.

3. What does Personal Injury Protection cover in Maine?

PIP coverage in Maine typically covers medical expenses, lost wages, and other related expenses that may result from an accident. This includes expenses for hospitalization, surgery, x-rays, and other medical procedures.

PIP coverage may also cover expenses for rehabilitation, funeral costs, and other related expenses. It’s important to review your policy carefully to understand exactly what is covered under your PIP coverage.

4. Can I waive Personal Injury Protection in Maine?

In Maine, drivers have the option to waive PIP coverage if they have health insurance that covers injuries resulting from car accidents. However, it’s important to note that waiving PIP coverage may not always be the best option.

If you are involved in an accident and don’t have PIP coverage, you may be responsible for paying for your own medical expenses, lost wages, and other related costs. Additionally, health insurance may not cover all of the expenses related to a car accident.

5. How much Personal Injury Protection should I carry in Maine?

In Maine, drivers are required to carry a minimum of $2,000 in PIP coverage. However, it’s recommended that drivers carry more than the minimum in order to ensure that they are fully covered in case of an accident.

Review your policy carefully to determine how much PIP coverage you have and whether you need to increase your coverage to better protect yourself in case of an accident.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection (PIP) is required in Maine. This means that all drivers are required to have a minimum amount of PIP coverage in their auto insurance policies. The purpose of this requirement is to ensure that individuals injured in car accidents have access to medical treatment and other necessary services, regardless of who is at fault for the accident.

While some drivers may view PIP as an unnecessary expense, the reality is that accidents can happen to anyone at any time. Without adequate insurance coverage, individuals may face significant financial burdens associated with medical bills, lost wages, and other expenses related to their injuries.

Ultimately, the requirement for PIP coverage in Maine is designed to protect both drivers and passengers on the road. By ensuring that everyone has access to the medical care they need in the aftermath of an accident, the state is taking an important step towards promoting safety and well-being for all.

Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases from minor injuries to devastating accidents, earning him a sterling reputation as a trusted and passionate advocate for justice. Brenton's unwavering dedication to his clients has cemented his position as a sought-after personal injury attorney.

- Latest Posts by Brenton Armour

-

Can You Get A Misdiagnosis Cataracts?

- -

South Carolina Dog Bite Laws?

- -

Iowa Dog Bite Laws?

- All Posts