Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases...Read more

Arkansas is a state that has its own set of laws when it comes to car accidents. One of the most important things to know about Arkansas is whether or not it is a no-fault state. Understanding the legalities surrounding car accidents is crucial, especially if you find yourself involved in one.

If you are wondering whether Arkansas is a no-fault state for car accidents, the answer is no. This means that if you are involved in a car accident in Arkansas, the at-fault driver is responsible for paying for the damages and injuries they caused. However, it’s important to understand the specific laws and regulations in Arkansas to ensure that you are properly compensated for any damages or injuries sustained in a car accident.

Yes, Arkansas is a “fault” state when it comes to car accidents. This means that the person who is found to be at fault for the accident is responsible for paying for the damages and injuries they caused. However, Arkansas does require all drivers to carry minimum liability insurance to cover damages and injuries they may cause in an accident.

Contents

- Is Arkansas a No Fault State for Car Accidents?

- Frequently Asked Questions

- Question 1: Is Arkansas a no-fault state?

- Question 2: What is the statute of limitations for car accident claims in Arkansas?

- Question 3: What damages can I recover in a car accident claim in Arkansas?

- Question 4: What should I do if I’m involved in a car accident in Arkansas?

- Question 5: Should I hire a car accident attorney in Arkansas?

- Can You Get A Misdiagnosis Cataracts?

- South Carolina Dog Bite Laws?

- Iowa Dog Bite Laws?

Is Arkansas a No Fault State for Car Accidents?

If you are a driver in Arkansas, you may be wondering if the state is a no-fault state for car accidents. No-fault insurance means that drivers involved in an accident are covered by their own insurance company, regardless of who is at fault. In this article, we will explore the laws around car insurance in Arkansas and whether or not it is a no-fault state.

Understanding Car Insurance in Arkansas

Car insurance is a requirement for all drivers in Arkansas. The state requires drivers to have liability insurance that covers at least $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage. These minimum requirements are in place to ensure that drivers are financially responsible for any damages they cause in an accident.

In addition to liability insurance, Arkansas drivers can also opt for additional coverage options such as collision, comprehensive, and uninsured/underinsured motorist coverage. These coverage options provide additional protection in the event of an accident or if the other driver does not have sufficient insurance.

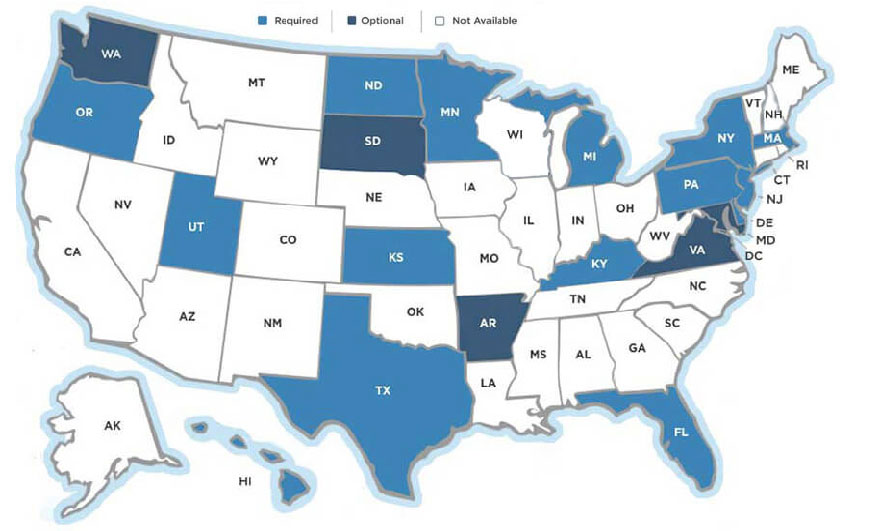

No-Fault Laws in Arkansas

Arkansas is not a no-fault state for car accidents. This means that drivers involved in an accident are responsible for their own damages, and insurance companies will generally determine who is at fault for the accident. The driver who is determined to be at fault will be responsible for paying for damages to the other driver’s vehicle and any injuries sustained in the accident.

However, Arkansas does have a modified comparative negligence law, which means that if both drivers are found to be at fault for the accident, the damages will be divided based on each driver’s percentage of fault. If a driver is found to be more than 50% at fault, they will not be able to recover any damages from the other driver.

The Benefits of No-Fault Insurance

While Arkansas is not a no-fault state for car accidents, there are some benefits to having no-fault insurance. One of the main benefits is that it can simplify the claims process, as drivers do not need to determine who is at fault for the accident. This can also help to reduce the number of lawsuits related to car accidents.

Another benefit of no-fault insurance is that it can provide more timely compensation for damages and injuries sustained in an accident. With no-fault insurance, drivers can file a claim with their own insurance company and receive compensation for their damages without having to wait for a determination of fault.

No-Fault vs. Fault Insurance

While no-fault insurance can have its benefits, there are also drawbacks to this type of insurance system. One of the main drawbacks is that it can lead to higher insurance premiums, as insurance companies are responsible for paying out claims regardless of who is at fault for the accident.

In a fault-based insurance system, drivers are responsible for paying for damages and injuries they cause in an accident. This can help to keep insurance premiums lower, as insurance companies are not responsible for paying out claims in every accident.

Conclusion

In conclusion, Arkansas is not a no-fault state for car accidents. Drivers involved in an accident are responsible for their own damages, and insurance companies will generally determine who is at fault for the accident. While no-fault insurance can have its benefits, there are also drawbacks to this type of insurance system. It is important for drivers in Arkansas to understand their insurance coverage options and the laws around car insurance in the state.

Frequently Asked Questions

If you’ve been involved in a car accident in Arkansas, you may be wondering whether the state is a no-fault state. Here are some common questions and answers to help you understand how fault is determined in car accidents in Arkansas.

Question 1: Is Arkansas a no-fault state?

No, Arkansas is not a no-fault state. In Arkansas, fault is determined in car accidents based on who was negligent or at fault for the accident. The insurance company of the at-fault driver is responsible for paying for the damages caused in the accident.

However, Arkansas does have a modified comparative fault system, which means that if you were partially at fault for the accident, your compensation may be reduced by the percentage of fault assigned to you.

Question 2: What is the statute of limitations for car accident claims in Arkansas?

The statute of limitations for car accident claims in Arkansas is three years from the date of the accident. This means that you have three years from the date of the accident to file a lawsuit for damages. If you do not file within this time frame, you may lose your right to seek compensation.

It’s important to note that some claims, such as those involving government entities, may have different deadlines and procedures. It’s best to consult with an experienced car accident attorney to ensure that you meet all deadlines and requirements.

Question 3: What damages can I recover in a car accident claim in Arkansas?

In Arkansas, you may be able to recover damages for medical expenses, lost wages, property damage, and pain and suffering. If you were partially at fault for the accident, your compensation may be reduced by the percentage of fault assigned to you.

If the at-fault driver was uninsured or underinsured, you may also be able to recover damages from your own insurance company under your uninsured/underinsured motorist coverage.

Question 4: What should I do if I’m involved in a car accident in Arkansas?

If you’re involved in a car accident in Arkansas, the first thing you should do is make sure everyone is safe and call 911 if anyone is injured. You should also exchange contact and insurance information with the other driver(s) involved.

Afterwards, it’s important to seek medical attention even if you don’t feel injured. Some injuries, such as whiplash, may not show symptoms right away but can become more serious over time. It’s also a good idea to document the accident by taking photos and getting witness information.

Question 5: Should I hire a car accident attorney in Arkansas?

If you’ve been involved in a car accident in Arkansas, it’s usually a good idea to consult with an experienced car accident attorney. An attorney can help you navigate the legal process, negotiate with insurance companies, and ensure that you receive fair compensation for your damages.

Most car accident attorneys offer free consultations, so you can discuss your case and determine whether hiring an attorney is the right choice for you.

In conclusion, Arkansas is not a pure no fault state for car accidents. However, it does have some no fault provisions that can come into play in certain situations. It is important for drivers to understand the state’s laws and regulations regarding car accidents and insurance coverage to ensure they are protected in the event of an accident.

While fault is considered in determining liability for damages and injuries, Arkansas does have a no fault provision for medical expenses. This means that each driver’s insurance policy will cover their own medical expenses regardless of who was at fault for the accident. This can help alleviate some of the financial burden for drivers involved in accidents.

Overall, while Arkansas may not be a pure no fault state for car accidents, it does have some provisions in place to protect drivers. It is important to understand these provisions and to have adequate insurance coverage to ensure you are protected in the event of an accident. By following the state’s laws and regulations, drivers can help protect themselves and others on the road.

Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases from minor injuries to devastating accidents, earning him a sterling reputation as a trusted and passionate advocate for justice. Brenton's unwavering dedication to his clients has cemented his position as a sought-after personal injury attorney.

- Latest Posts by Brenton Armour

-

Can You Get A Misdiagnosis Cataracts?

- -

South Carolina Dog Bite Laws?

- -

Iowa Dog Bite Laws?

- All Posts