Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases...Read more

As an employee, you work hard every day to provide for yourself and your family. You put in long hours, often performing physically demanding tasks, and sometimes accidents happen. If you’ve been injured on the job, you may be entitled to claim occupational injury tax.

The process of claiming occupational injury tax can be confusing and overwhelming, but it’s important to know your rights and take advantage of the benefits available to you. In this guide, we’ll walk you through the steps to claim occupational injury tax and help you navigate the process with ease. So, let’s get started!

- Fill out IRS Form 1040, Schedule A, and include the amount you spent on medical expenses related to the injury.

- You must also file Form 8853 to claim the tax deduction for occupational injuries or illnesses.

- Submit the forms along with any necessary documentation to the IRS.

How to Claim Occupational Injury Tax?

If you have suffered an injury while working, you may be eligible for occupational injury tax relief. This tax relief is designed to help individuals who have been injured while working to offset the financial impact of their injuries. In this article, we will explain how to claim occupational injury tax and the benefits that it can offer.

What is Occupational Injury Tax?

Occupational injury tax is a tax relief that is available to individuals who have suffered an injury while working. This tax relief is designed to help individuals who have been injured while working to offset the financial impact of their injuries. The tax relief is available to both employees and self-employed individuals who have suffered an injury while working.

To be eligible for occupational injury tax relief, you must have been injured while working and the injury must have been caused by an accident that occurred during the course of your employment. Additionally, you must have incurred expenses as a result of your injury that were not reimbursed by your employer or any other source.

Benefits of Claiming Occupational Injury Tax

Claiming occupational injury tax can provide a number of benefits, including:

- Offsetting the financial impact of your injury

- Reducing your tax liability

- Providing financial support while you recover from your injury

How to Claim Occupational Injury Tax

To claim occupational injury tax, you will need to complete a Form 11D. This form can be obtained from the Revenue Commissioners website or by contacting your local tax office. The form requires you to provide details about your injury, including the date it occurred and the expenses that you have incurred as a result of your injury.

Once you have completed the form, you will need to submit it to your local tax office. The Revenue Commissioners will review your claim and will determine whether or not you are eligible for occupational injury tax relief.

What Expenses Can Be Claimed?

You can claim a wide range of expenses as part of your occupational injury tax claim. Some of the most common expenses that can be claimed include:

- Medical expenses, including doctor and hospital bills

- Travel expenses related to your injury

- Cost of special equipment or adaptations to your home or car

- Loss of earnings due to your injury

It is important to keep receipts and documentation for all of the expenses that you are claiming as part of your occupational injury tax claim. This will help to ensure that your claim is processed as quickly and efficiently as possible.

Occupational Injury Tax vs. Personal Injury Claims

It is important to note that occupational injury tax relief is different from personal injury claims. Personal injury claims are a legal process that is used to seek compensation for injuries that have been caused by another person’s negligence. Occupational injury tax relief, on the other hand, is a tax relief that is designed to provide financial support to individuals who have been injured while working.

While personal injury claims can provide significant financial compensation, they can also be time-consuming and stressful. Occupational injury tax relief, on the other hand, is a straightforward process that can help to offset the financial impact of your injury without the need for legal action.

Conclusion

If you have suffered an injury while working, claiming occupational injury tax can help to offset the financial impact of your injury. By following the steps outlined in this article, you can ensure that you are eligible for occupational injury tax relief and that your claim is processed as quickly and efficiently as possible. Remember to keep accurate records of all of your expenses and to seek professional advice if you are unsure about any aspect of your claim.

Contents

Frequently Asked Questions

Here are some common questions and answers related to claiming occupational injury tax:

What is occupational injury tax?

Occupational injury tax is a tax relief provided to employees who have suffered from an injury or illness as a result of their work. The tax relief is designed to provide financial support to those who have been impacted by a work-related injury or illness.

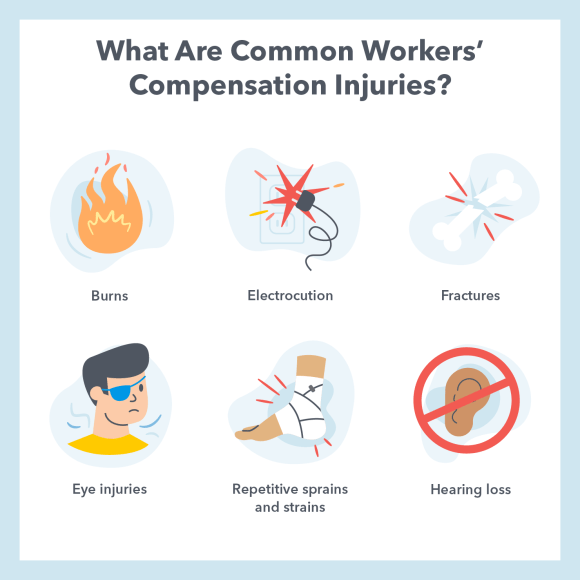

To claim occupational injury tax, you must have suffered an injury or illness as a direct result of your work. This can include physical injuries, such as fractures or sprains, as well as illnesses caused by exposure to hazardous substances, such as asbestos or chemicals.

How do I claim occupational injury tax?

To claim occupational injury tax, you must complete and submit a P87 form to HM Revenue and Customs (HMRC). The form can be completed online or in paper format and must include details of the injury or illness you have suffered, as well as any medical expenses you have incurred as a result.

You should also provide evidence of your injury or illness, such as a doctor’s note or medical report, to support your claim. This will help to ensure that your claim is processed quickly and accurately.

What expenses can I claim for occupational injury tax?

You can claim for a range of expenses related to your work-related injury or illness, including medical expenses, travel costs, and loss of earnings. Medical expenses can include the cost of prescription medication, physiotherapy, and hospital treatment, while travel costs can include the cost of travel to and from medical appointments.

You can also claim for loss of earnings if you have been unable to work as a result of your injury or illness. This can provide financial support to help you cover your living expenses while you recover from your injury or illness.

How much occupational injury tax can I claim?

The amount of occupational injury tax you can claim will depend on a range of factors, including the severity of your injury or illness and the expenses you have incurred as a result. In general, you can claim for the full cost of any medical expenses and travel costs you have incurred, as well as up to 80% of your lost earnings.

You should keep detailed records of any expenses you have incurred as a result of your work-related injury or illness, as this will help to ensure that your claim is processed accurately and efficiently.

When should I claim occupational injury tax?

You should claim occupational injury tax as soon as possible after you have suffered an injury or illness as a result of your work. This will help to ensure that your claim is processed quickly and accurately, and that you receive the financial support you need to cover your expenses and support your recovery.

If you are unsure whether you are eligible to claim occupational injury tax, or if you need help completing your claim form, you can contact HMRC or speak to a tax advisor for guidance and support.

In conclusion, claiming occupational injury tax can be a daunting process, but it is important to know your rights as an employee. By following the proper steps and providing the necessary documentation, you can receive the compensation you deserve for any work-related injuries. Remember to keep detailed records and seek professional advice if needed.

It is also important to prioritize workplace safety to prevent future injuries. Employers should take proactive measures to ensure that their employees are protected and provided with proper training and equipment. By working together, we can create a safer and healthier work environment for everyone.

In the end, claiming occupational injury tax is not just about receiving financial compensation, but also about advocating for your rights as an employee and promoting a culture of safety in the workplace. So, stay informed, stay safe, and don’t hesitate to take action when necessary.

Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases from minor injuries to devastating accidents, earning him a sterling reputation as a trusted and passionate advocate for justice. Brenton's unwavering dedication to his clients has cemented his position as a sought-after personal injury attorney.

- Latest Posts by Brenton Armour

-

Can You Get A Misdiagnosis Cataracts?

- -

South Carolina Dog Bite Laws?

- -

Iowa Dog Bite Laws?

- All Posts