Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases...Read more

As a responsible driver, you probably already have car insurance coverage that includes personal injury protection (PIP). But with so many different types of coverage available, you may be wondering if you need additional PIP coverage.

In this article, we’ll explore what PIP coverage is, what it covers, and whether or not you should consider increasing your coverage limits. By the end, you’ll have a better understanding of your options and be able to make an informed decision about your car insurance coverage.

Do I Need Additional Personal Injury Protection?

If you’re already covered by health insurance or have a solid emergency fund, you may not need to purchase additional personal injury protection (PIP) on your auto insurance policy. However, if you’re concerned about medical expenses and lost wages in the event of an accident, or if you don’t have health insurance, additional PIP coverage may be worth considering. It’s important to review your policy and consult with your insurance agent to determine what coverage is best for your individual needs.

Do I Need Additional Personal Injury Protection?

Personal injury protection (PIP) is a type of insurance coverage that pays for medical expenses, lost wages, and other damages if you are injured in a car accident. While PIP is not required in all states, it can be a valuable addition to your auto insurance policy. In this article, we will explore whether or not you need additional personal injury protection.

What is Personal Injury Protection?

Personal injury protection (PIP) is a type of insurance coverage that pays for medical expenses, lost wages, and other damages if you are injured in a car accident, regardless of who is at fault. PIP is often referred to as “no-fault” insurance because it pays benefits regardless of who caused the accident.

In addition to medical expenses and lost wages, PIP may also cover expenses such as rehabilitation, funeral costs, and household services. PIP coverage varies by state, so it’s important to check your policy or speak with your insurance agent to understand what is covered.

Do You Need Additional PIP Coverage?

Whether or not you need additional PIP coverage depends on a few factors. If you live in a state that requires PIP coverage, you may already have the minimum amount of coverage required by law. However, if you live in a state that does not require PIP coverage or if you want additional coverage, you may want to consider adding it to your policy.

If you have good health insurance that covers medical expenses, you may not need additional PIP coverage. However, if your health insurance has a high deductible or does not cover certain types of medical expenses, PIP coverage can help fill in the gaps.

Benefits of Additional PIP Coverage

There are several benefits of adding additional PIP coverage to your policy.

Firstly, PIP coverage can provide additional protection for you and your passengers in the event of an accident. If you or your passengers are injured, PIP can help cover medical expenses and lost wages, regardless of who is at fault. This can provide peace of mind and financial security in the event of an accident.

Secondly, PIP coverage can provide coverage for expenses that are not covered by your health insurance. For example, PIP may cover expenses such as rehabilitation, funeral costs, and household services, which are not typically covered by health insurance.

PIP Coverage vs. Medical Payments Coverage

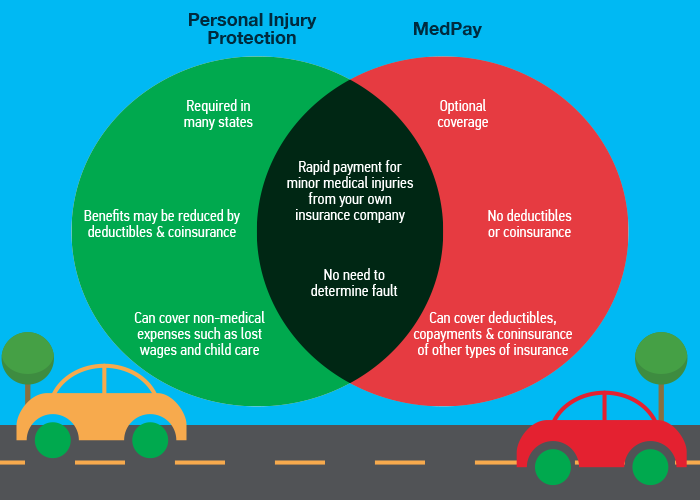

Medical payments coverage (MedPay) is another type of insurance coverage that pays for medical expenses if you or your passengers are injured in a car accident. While MedPay is similar to PIP, there are some key differences.

MedPay only covers medical expenses, while PIP covers medical expenses, lost wages, and other damages. Additionally, MedPay coverage limits are typically lower than PIP coverage limits.

If you have good health insurance that covers medical expenses, you may not need MedPay coverage. However, if you want additional coverage for medical expenses, MedPay can be a valuable addition to your policy.

Conclusion

In conclusion, whether or not you need additional personal injury protection depends on your individual circumstances. If you live in a state that requires PIP coverage, you may already have the minimum amount of coverage required by law. However, if you want additional protection for you and your passengers, or if your health insurance has a high deductible or does not cover certain types of medical expenses, additional PIP coverage can be a valuable addition to your policy.

Before making a decision, it’s important to review your policy and speak with your insurance agent to understand your options and what is covered. With the right coverage, you can have peace of mind and financial security in the event of an accident.

Contents

- Frequently Asked Questions

- 1. What is personal injury protection?

- 2. Do I need personal injury protection if I have health insurance?

- 3. What does personal injury protection cover?

- 4. How much personal injury protection do I need?

- 5. Do I need personal injury protection if I have disability insurance?

- Florida Car Insurance 101: What is PIP (Personal Injury Protection) Coverage?

- Can You Get A Misdiagnosis Cataracts?

- South Carolina Dog Bite Laws?

- Iowa Dog Bite Laws?

Frequently Asked Questions

Personal injury protection (PIP) is a type of car insurance that covers medical expenses and, in some cases, lost wages and other expenses. While PIP is not required in all states, it can provide valuable protection in the event of an accident. Here are some common questions about whether or not you need additional PIP coverage.

1. What is personal injury protection?

Personal injury protection (PIP) is a type of car insurance that covers medical expenses and, in some cases, lost wages and other expenses. PIP is designed to provide coverage regardless of who is at fault in an accident, and it may also cover expenses related to rehabilitation and other types of care. Some states require drivers to carry PIP coverage, while others do not.

If you live in a state where PIP is not required, you may still want to consider purchasing additional coverage. This can provide added protection in the event of an accident, and may help you avoid high out-of-pocket expenses related to medical care or other expenses.

2. Do I need personal injury protection if I have health insurance?

If you have health insurance, you may be wondering whether or not you need personal injury protection (PIP). While health insurance can help cover medical expenses related to an accident, PIP can provide additional protection and may help cover lost wages and other expenses that are not covered by health insurance.

Ultimately, the decision of whether or not to purchase PIP coverage will depend on your individual needs and circumstances. If you are concerned about the potential costs associated with an accident, or if you have a high deductible on your health insurance policy, you may want to consider purchasing additional PIP coverage.

3. What does personal injury protection cover?

Personal injury protection (PIP) is designed to cover medical expenses and, in some cases, lost wages and other expenses related to an accident. PIP is often referred to as “no-fault” insurance, as it is designed to provide coverage regardless of who is at fault in an accident.

Depending on your policy, PIP may cover expenses related to hospital visits, surgery, and other types of medical care. It may also cover expenses related to rehabilitation and other types of care that are necessary for recovery after an accident.

4. How much personal injury protection do I need?

The amount of personal injury protection (PIP) coverage you need will depend on your individual needs and circumstances. If you have health insurance that covers medical expenses related to an accident, you may not need as much PIP coverage as someone who does not have health insurance.

When choosing a PIP policy, it is important to consider factors such as your deductible, your budget, and how much coverage you need to feel protected in the event of an accident. You may want to consult with an insurance professional to help you choose the right PIP policy for your needs.

5. Do I need personal injury protection if I have disability insurance?

If you have disability insurance, you may be wondering whether or not you need personal injury protection (PIP). While disability insurance can help cover lost wages related to an accident, PIP can provide additional protection and may cover other expenses that are not covered by disability insurance.

Ultimately, the decision of whether or not to purchase PIP coverage will depend on your individual needs and circumstances. If you are concerned about the potential costs associated with an accident, or if you have a high deductible on your disability insurance policy, you may want to consider purchasing additional PIP coverage.

Florida Car Insurance 101: What is PIP (Personal Injury Protection) Coverage?

In today’s world, accidents are happening more often than we would like. Medical bills, lost wages and other expenses can quickly add up if you are injured in an accident. This is why it’s important to consider whether or not you need additional personal injury protection.

Personal injury protection (PIP) is an optional insurance coverage that can help you pay for medical expenses and lost wages if you are in an accident. If you already have health insurance and disability insurance, you may wonder if you need additional PIP.

However, it’s important to consider that health insurance may not cover all the expenses related to an accident, and disability insurance may not cover lost wages for a short-term disability. Additional PIP can help fill in these gaps and provide you with the financial protection you need.

In conclusion, while additional PIP may not be necessary for everyone, it’s important to consider your unique situation and the potential risks you face. By taking the time to evaluate your needs and options, you can make an informed decision about whether or not additional PIP is right for you.

Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases from minor injuries to devastating accidents, earning him a sterling reputation as a trusted and passionate advocate for justice. Brenton's unwavering dedication to his clients has cemented his position as a sought-after personal injury attorney.

- Latest Posts by Brenton Armour

-

Can You Get A Misdiagnosis Cataracts?

- -

South Carolina Dog Bite Laws?

- -

Iowa Dog Bite Laws?

- All Posts