Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases...Read more

Car accidents can be a traumatic experience, both physically and emotionally. And dealing with insurance after an accident can be overwhelming and confusing. From filing a claim to negotiating with insurance companies, it can be a daunting task. But don’t worry, we’ve got you covered. In this article, we’ll guide you through the process of handling insurance after a car accident, so you can get the compensation you deserve and move on with your life.

Whether it’s a minor fender bender or a major collision, knowing how to navigate the insurance claims process can make all the difference in getting your car fixed and your medical bills paid. We’ll cover everything from what to do at the scene of the accident to filing a claim with your insurance company. So, sit back, relax, and let’s get started on the journey to getting your life back on track after a car accident.

- Call your insurance company as soon as possible to report the accident.

- Exchange information with the other driver(s) involved in the accident.

- Take photos of the damage to your car and any injuries you sustained.

- Get a copy of the police report.

- Be honest and accurate when giving your account of the accident to your insurance company.

- Consider hiring an attorney if you are having trouble with your insurance company or the other driver’s insurance company.

Contents

- Handling Insurance After a Car Accident: A Complete Guide

- Frequently Asked Questions

- What should I do after a car accident?

- What information do I need to provide to my insurance company after a car accident?

- How does insurance coverage work after a car accident?

- What happens if the other driver does not have insurance?

- When should I contact an attorney after a car accident?

- Can You Get A Misdiagnosis Cataracts?

- South Carolina Dog Bite Laws?

- Iowa Dog Bite Laws?

Handling Insurance After a Car Accident: A Complete Guide

1. Contact Your Insurance Company

After a car accident, the first step is to contact your insurance company. This is important even if the accident was not your fault. You should provide all the necessary details to your insurance company, such as the date and time of the accident, the location, and the extent of the damage. Your insurance company will then guide you through the claims process.

It is important to note that you should not admit fault or agree to any settlement offer until you have spoken to your insurance company. You should also avoid discussing the accident with the other party’s insurance company or signing any documents without consulting your insurance company.

2. Gather Evidence

To support your insurance claim, you should gather as much evidence as possible. This includes taking photos of the accident scene, the damage to both vehicles, and any injuries sustained. You should also take note of any witnesses and their contact information.

You should keep all the documents related to the accident, such as police reports, medical bills, and repair estimates. This will help you provide evidence of the costs incurred due to the accident.

3. Understand Your Coverage

It is important to understand your insurance coverage before filing a claim. This includes knowing your deductibles, limits, and exclusions. Your insurance company will provide you with a copy of your policy, which you should read carefully.

You should also know the types of coverage available to you, such as liability, collision, and comprehensive insurance. Understanding your coverage will help you make informed decisions during the claims process.

4. File a Claim

Once you have contacted your insurance company and gathered all the necessary evidence, you can file a claim. Your insurance company will guide you through the process, which may involve filling out forms and providing additional information.

You should be prepared to answer questions about the accident and provide evidence of the costs incurred. Your insurance company will then determine the amount of compensation you are entitled to.

5. Get a Rental Car

If your vehicle is not drivable after the accident, you may need a rental car. This will help you get around while your vehicle is being repaired. Your insurance company may provide a rental car or reimburse you for the cost of renting one.

You should also know the limitations of your rental car coverage, such as the maximum amount of rental days or the type of rental car covered.

6. Get Your Vehicle Repaired

After filing a claim, your insurance company will provide you with a list of approved repair shops. You should choose a reputable repair shop and provide them with the necessary documents, such as the repair estimate and the insurance company’s approval.

You should also know the limitations of your coverage, such as the maximum amount of repair costs covered or the type of repairs covered.

7. Consider Hiring an Attorney

If you are involved in a complex or disputed accident, you may want to consider hiring an attorney. An attorney can help you with the claims process, negotiate with the insurance companies, and represent you in court if necessary.

You should also know the costs and benefits of hiring an attorney, such as the attorney’s fees and the potential for a higher settlement.

8. Be Aware of Insurance Fraud

Insurance fraud is a serious crime that can result in fines, imprisonment, and loss of insurance coverage. You should be aware of the signs of insurance fraud, such as staged accidents, fake injuries, and inflated repair costs.

You should also report any suspicious activity to your insurance company or the authorities.

9. Review Your Policy Annually

Your insurance needs may change over time, so it is important to review your policy annually. You should check if you need to adjust your coverage, such as increasing your liability limits or adding additional coverage.

You should also compare your insurance rates with other providers to ensure you are getting the best value for your money.

10. Stay Safe on the Road

The best way to handle insurance after a car accident is to avoid accidents altogether. You should practice safe driving habits, such as obeying traffic laws, avoiding distractions, and maintaining your vehicle.

You should also know what to do in case of an accident, such as contacting your insurance company and gathering evidence.

In conclusion, handling insurance after a car accident can be a complex process. By following these steps and understanding your coverage, you can ensure a smooth claims process and receive the compensation you are entitled to.

Frequently Asked Questions

What should I do after a car accident?

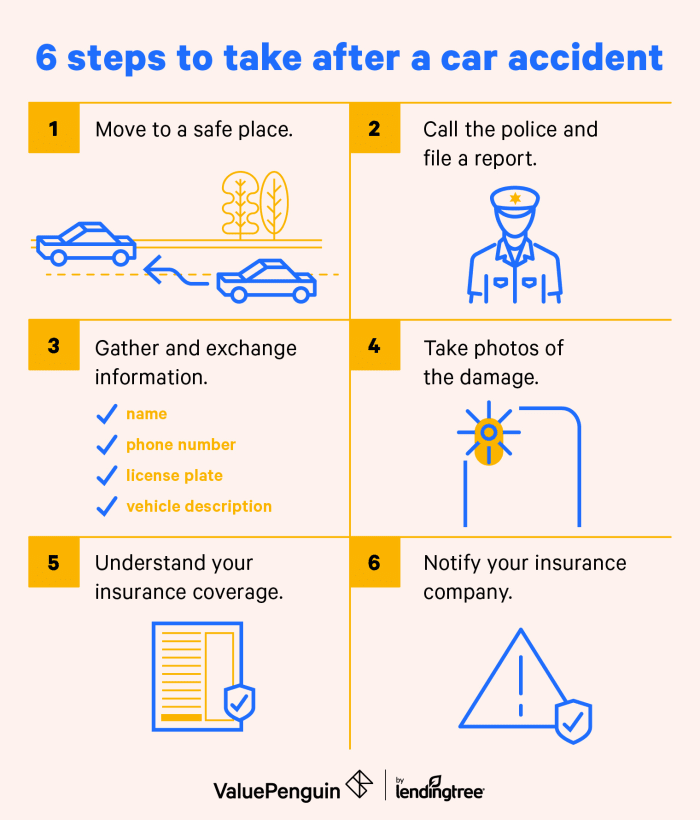

After a car accident, the first thing you should do is check yourself and your passengers for injuries. If anyone is injured, call for medical assistance immediately. Next, call the police and report the accident. Exchange contact and insurance information with the other driver involved in the accident. Take photos of the damage to both vehicles and the accident scene. Finally, notify your insurance company to report the accident.

It is important to note that you should avoid discussing fault with the other driver or making any statements that could be used against you later. Stick to the facts and let the police and insurance companies handle the investigation.

What information do I need to provide to my insurance company after a car accident?

When reporting a car accident to your insurance company, you will need to provide the date and location of the accident, a description of what happened, and the contact information of the other driver involved in the accident. You will also need to provide your insurance policy number and any photos or documentation of the damage to your vehicle.

Be honest and provide as much detail as possible when reporting the accident to your insurance company. Failure to disclose important information could result in your claim being denied.

How does insurance coverage work after a car accident?

If you are at fault for a car accident, your liability insurance will cover the cost of damages and injuries sustained by the other driver and passengers. Your collision insurance will cover the cost of repairs to your own vehicle. If you are not at fault for the accident, the other driver’s insurance will cover the cost of damages and injuries, including repairs to your vehicle.

It is important to note that insurance coverage is subject to policy limits, deductibles, and exclusions. Be sure to review your insurance policy carefully to understand your coverage and any limitations.

What happens if the other driver does not have insurance?

If the other driver involved in the accident does not have insurance, you may still be able to recover damages through your own insurance policy. Uninsured motorist coverage can help cover the cost of damages and injuries sustained in an accident with an uninsured driver.

If you do not have uninsured motorist coverage, you may need to file a lawsuit against the other driver to recover damages. It is important to consult with an attorney to understand your legal options in this situation.

When should I contact an attorney after a car accident?

If you or any passengers in your vehicle have sustained serious injuries in a car accident, or if there is a dispute over who was at fault for the accident, it may be necessary to consult with an attorney. An attorney can help you navigate the legal process and ensure that your rights are protected.

Additionally, if you are being sued by another driver involved in the accident, it is important to contact an attorney immediately. A qualified attorney can help you defend yourself against the lawsuit and protect your assets.

In conclusion, dealing with insurance after a car accident can be a daunting task. However, by following the steps mentioned above, you can make the process less stressful and more manageable.

Firstly, always make sure to gather as much information as possible at the scene of the accident, including the other driver’s insurance details and contact information. This will make it easier to file a claim later on.

Secondly, be sure to report the accident to your insurance company as soon as possible. This will help ensure that your claim is processed quickly and efficiently.

Finally, be prepared to negotiate with your insurance company if necessary. While they may not always offer you the settlement you want, by staying calm and presenting your case clearly, you may be able to reach a mutually beneficial agreement.

By keeping these tips in mind, you can handle insurance after a car accident with confidence and ease. Remember, accidents happen, but with the right preparation and approach, you can bounce back stronger than ever.

Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases from minor injuries to devastating accidents, earning him a sterling reputation as a trusted and passionate advocate for justice. Brenton's unwavering dedication to his clients has cemented his position as a sought-after personal injury attorney.

- Latest Posts by Brenton Armour

-

Can You Get A Misdiagnosis Cataracts?

- -

South Carolina Dog Bite Laws?

- -

Iowa Dog Bite Laws?

- All Posts