Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases...Read more

Have you ever wondered how much tax you have to pay on your injury claim settlement? The good news is that in most cases, injury claim settlements are tax-free. However, there are some exceptions to this rule, and it’s important to know what they are to avoid any surprises come tax time.

If you’ve suffered an injury due to someone else’s negligence and have received a settlement, you may be wondering how much of it you get to keep after taxes. The general rule is that injury claim settlements are tax-free, but there are a few exceptions. Understanding how taxes apply to your settlement can help you plan for the future and avoid any unexpected tax bills. Let’s dive into the details of how much tax on injury claims.

How Much Tax on Injury Claims?

If you have suffered an injury and are considering filing a personal injury claim, you may be wondering how much of your settlement or award will be taxed. The answer can be a bit complicated, as it depends on a number of factors. In this article, we’ll explore the taxation of personal injury claims and give you a better idea of what to expect.

What Is a Personal Injury Claim?

A personal injury claim is a legal action taken by someone who has been injured due to the negligence or intentional actions of another party. The goal of a personal injury claim is to seek compensation for the damages caused by the injury, such as medical expenses, lost wages, and pain and suffering.

Compensatory Damages

Compensatory damages are the most common type of damages awarded in personal injury cases. They are intended to compensate the injured party for their losses. Compensatory damages can include medical expenses, lost wages, and pain and suffering.

Punitive Damages

In rare cases, punitive damages may be awarded in addition to compensatory damages. Punitive damages are intended to punish the party responsible for the injury and deter them from engaging in similar behavior in the future.

Are Personal Injury Settlements Taxable?

In most cases, personal injury settlements are not taxable. This is because the settlement is intended to compensate the injured party for their losses and is not considered income. However, there are some exceptions.

Lost Wages

If your personal injury settlement includes compensation for lost wages, that portion of the settlement may be taxable. This is because lost wages would have been subject to income tax if they had been earned.

Punitive Damages

If your personal injury settlement includes punitive damages, that portion of the settlement may be taxable. Punitive damages are not intended to compensate the injured party for their losses and are instead intended to punish the party responsible for the injury.

What About Personal Injury Awards?

Like settlements, personal injury awards are generally not taxable. However, there are some exceptions.

Interest on Awards

If your personal injury award includes interest, that portion of the award may be taxable. This is because interest is considered income.

Punitive Damages

If your personal injury award includes punitive damages, that portion of the award may be taxable.

Workers’ Compensation and Social Security Disability Benefits

If you receive workers’ compensation or Social Security disability benefits, those benefits are generally not taxable. However, if you receive a personal injury settlement or award that includes compensation for lost wages, that portion of the settlement or award may be taxable.

Offset for Social Security

If you receive Social Security disability benefits and also receive a personal injury settlement or award that includes compensation for lost wages, your Social Security benefits may be offset. This means that your Social Security benefits may be reduced to account for the additional income.

What Are the Benefits of Hiring a Personal Injury Lawyer?

If you have suffered an injury due to the negligence or intentional actions of another party, it is important to hire a personal injury lawyer to help you navigate the legal system. A personal injury lawyer can help you:

Understand Your Rights

A personal injury lawyer can help you understand your legal rights and the options available to you.

Negotiate with Insurance Companies

A personal injury lawyer can negotiate with insurance companies on your behalf to ensure that you receive fair compensation for your injuries.

File a Lawsuit

If necessary, a personal injury lawyer can file a lawsuit on your behalf and represent you in court.

Personal Injury Claims Vs. Workers’ Compensation Claims

If you have been injured on the job, you may be wondering whether you should file a personal injury claim or a workers’ compensation claim. Here are some key differences:

Fault

In a personal injury claim, you must prove that the other party was at fault for your injuries. In a workers’ compensation claim, fault does not matter.

Compensation

In a personal injury claim, you may be entitled to compensation for a wide range of damages, including medical expenses, lost wages, and pain and suffering. In a workers’ compensation claim, you are typically only entitled to compensation for medical expenses and lost wages.

Deadlines

Deadlines for filing personal injury claims are typically shorter than deadlines for filing workers’ compensation claims.

Conclusion

If you have suffered an injury due to the negligence or intentional actions of another party, it is important to understand the taxation of personal injury claims. In most cases, personal injury settlements and awards are not taxable. However, there are some exceptions, such as compensation for lost wages and punitive damages. If you are unsure about the tax implications of your personal injury claim, it is important to consult with a tax professional.

Contents

- Frequently Asked Questions

- Is My Injury Claim Taxable?

- Are There Any Exceptions to the Rule?

- Do I Need to Report My Settlement or Verdict on My Tax Return?

- Can I Deduct Legal Fees Related to My Injury Claim?

- What Should I Do if I Have More Questions About Taxes and Injury Claims?

- Can You Get A Misdiagnosis Cataracts?

- South Carolina Dog Bite Laws?

- Iowa Dog Bite Laws?

Frequently Asked Questions

Here are some common questions and answers about how much tax is applied on injury claims.

Is My Injury Claim Taxable?

Generally speaking, no. The IRS does not consider money received through a personal injury settlement or verdict to be taxable income. This is because the money is intended to compensate the victim for their losses and expenses, not to provide them with any sort of profit.

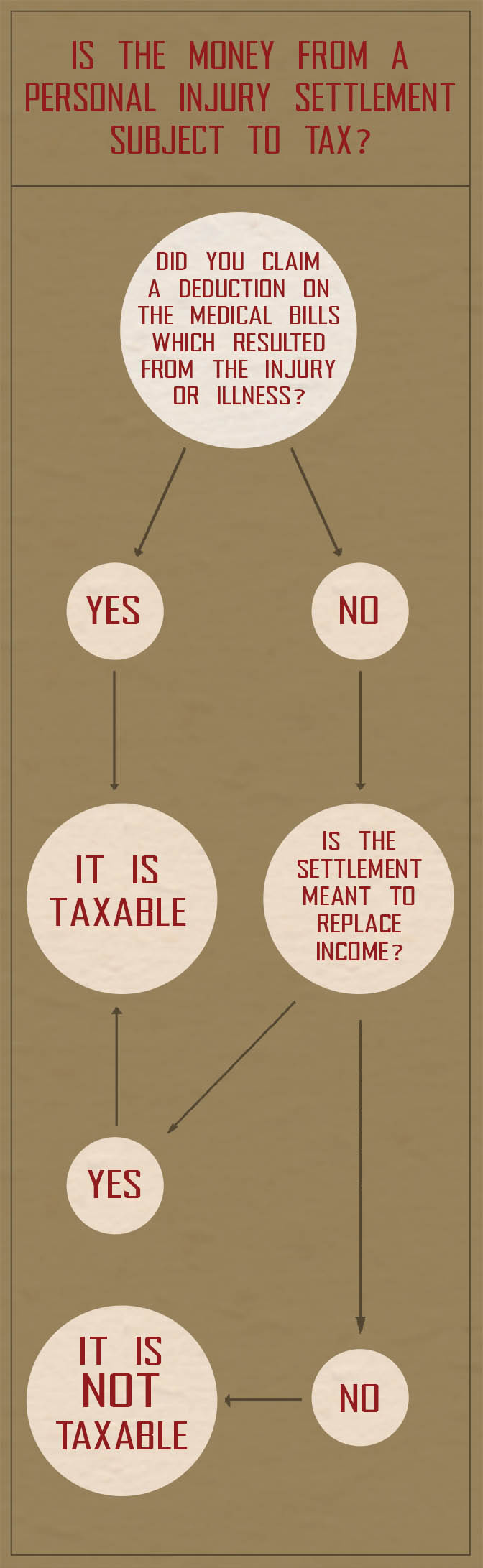

However, there are some exceptions to this rule. For example, if you took a tax deduction for medical expenses related to the injury in a previous year, and then receive a settlement or verdict that includes reimbursement for those expenses, you may need to report that portion of the settlement as taxable income.

Are There Any Exceptions to the Rule?

Yes, there are a few rare exceptions to the general rule that personal injury settlements and verdicts are not taxable. For example, if you received punitive damages in addition to compensatory damages (which are intended to punish the defendant rather than compensate you for your losses), that portion of your award may be taxable. Additionally, if you receive interest on the award (for example, if the defendant failed to pay the full amount owed in a timely manner), that interest may be taxable as well.

In these cases, it is important to consult with a tax professional to determine how much of your settlement or verdict is taxable and how to report it on your tax return.

Do I Need to Report My Settlement or Verdict on My Tax Return?

If your settlement or verdict is not taxable, you do not need to report it on your tax return. However, if any portion of your award is taxable (for example, if you received reimbursement for previously deducted medical expenses), you will need to report that portion as income on your tax return.

It is always a good idea to keep detailed records of your settlement or verdict and any related expenses, in case you need to report any portion of it on your tax return.

Can I Deduct Legal Fees Related to My Injury Claim?

In some cases, you may be able to deduct legal fees related to your injury claim on your tax return. However, this deduction is subject to certain limitations and restrictions, so it is important to consult with a tax professional to determine whether you are eligible to take the deduction and how much you can deduct.

Additionally, if you receive a settlement or verdict that includes reimbursement for legal fees, that portion of your award may be taxable, so it is important to keep detailed records and consult with a tax professional to ensure that you are accurately reporting your income and deductions.

What Should I Do if I Have More Questions About Taxes and Injury Claims?

If you have more questions about how taxes apply to personal injury settlements and verdicts, or if you need help reporting your award on your tax return, it is always a good idea to consult with a tax professional. They can help you navigate the complex rules and regulations related to injury claims and ensure that you are accurately reporting your income and deductions.

Additionally, your attorney may be able to provide guidance on tax-related issues related to your injury claim, so be sure to ask them if you have any questions or concerns.

In conclusion, knowing how much tax on injury claims can be a daunting task. However, taking the time to understand the tax implications can help you make informed decisions about your settlement.

It is important to note that the tax laws surrounding injury claims can vary depending on the type of compensation received. Compensatory damages, such as reimbursement for medical expenses and lost wages, are typically tax-free. On the other hand, punitive damages, which are meant to punish the responsible party, may be subject to taxation.

To avoid any surprises come tax season, it is advisable to consult with a tax professional who can provide guidance on your specific situation. This will ensure that you are prepared to handle any tax obligations that may arise from your injury claim settlement.

Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases from minor injuries to devastating accidents, earning him a sterling reputation as a trusted and passionate advocate for justice. Brenton's unwavering dedication to his clients has cemented his position as a sought-after personal injury attorney.

- Latest Posts by Brenton Armour

-

Can You Get A Misdiagnosis Cataracts?

- -

South Carolina Dog Bite Laws?

- -

Iowa Dog Bite Laws?

- All Posts