Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases...Read more

For many expecting parents, the joy of childbirth can also come with the fear of potential complications and injuries that may arise. But what happens if these injuries leave a mother unable to work long-term? Does long-term disability insurance cover injuries sustained during labor and birth?

This is an important question that many parents may be asking themselves, especially as the cost of raising a child continues to rise. In this article, we’ll explore the answer to this question and provide helpful information for parents looking to protect themselves and their families from unforeseen circumstances.

Long Term Disability Coverage for Injuries from Labor and Birth

Understanding Long Term Disability Insurance

Long term disability (LTD) insurance is designed to provide financial support to individuals who become disabled and unable to work for an extended period of time. The benefits offered by LTD insurance can be used to cover expenses such as medical bills, rent or mortgage payments, and other living expenses. LTD insurance is typically offered as part of an employee benefits package, although it can also be purchased independently.

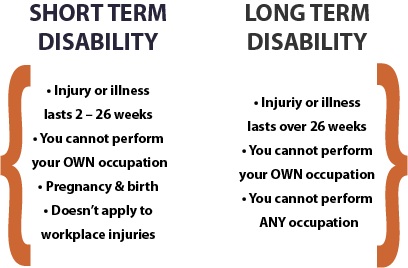

LTD insurance policies vary in their specific terms and conditions, but most require that the policyholder be unable to perform the duties of their occupation. Some policies also require a waiting period before benefits are paid out, typically ranging from 30 to 180 days.

Does LTD Cover Injuries from Labor and Birth?

Injuries sustained during labor and birth can be covered by LTD insurance, but it depends on the specific terms of the policy. Some policies exclude coverage for injuries related to pregnancy or childbirth, while others may provide coverage. It’s important to review the terms of your policy carefully to understand what is covered and what is not.

In some cases, a woman may be eligible for short-term disability benefits during her pregnancy and immediately following childbirth. Short-term disability benefits typically provide coverage for a period of up to six weeks after the birth of a child. However, once the short-term disability benefits have been exhausted, LTD insurance may provide coverage if the woman is still unable to work due to a disability related to the pregnancy or childbirth.

The Benefits of LTD Insurance

LTD insurance can provide a valuable safety net for individuals who become disabled and unable to work for an extended period of time. Some of the benefits of LTD insurance include:

– Financial security: LTD insurance can provide a source of income to cover living expenses while a person is unable to work due to a disability.

– Peace of mind: Knowing that you have LTD insurance can help reduce stress and anxiety related to potential disability in the future.

– Employer-provided coverage: Many employers offer LTD insurance as part of their benefits package, which can provide affordable coverage compared to purchasing a policy independently.

LTD Insurance vs. Workers’ Compensation

Workers’ compensation insurance is designed to provide benefits to employees who are injured or become ill as a result of their job. In contrast, LTD insurance provides benefits to individuals who become disabled due to a non-work-related injury or illness.

While both types of insurance provide financial support to individuals who are unable to work, the eligibility requirements and benefits can vary significantly. Workers’ compensation benefits typically cover medical expenses and a portion of lost wages, while LTD insurance benefits can cover a wider range of expenses, including living expenses and medical bills.

The Bottom Line

Injuries sustained during labor and birth can be covered by LTD insurance, but it’s important to review the specific terms of your policy. LTD insurance can provide valuable financial support to individuals who become disabled and unable to work for an extended period of time. If you’re considering purchasing LTD insurance, it’s important to compare policies and understand the benefits and limitations of each.

Contents

- Frequently Asked Questions

- Does Long Term Disability Cover Injuries From Labor and Birth?

- What Types of Long Term Disability Insurance Policies Cover Injuries from Labor and Birth?

- What Are Some Common Labor and Birth Injuries Covered by Long Term Disability Insurance?

- What Documents Are Needed to Apply for Long Term Disability Coverage for Labor and Birth Injuries?

- How Can I Make Sure I am Covered for Labor and Birth Injuries Under My Long Term Disability Insurance Policy?

- Can You Get A Misdiagnosis Cataracts?

- South Carolina Dog Bite Laws?

- Iowa Dog Bite Laws?

Frequently Asked Questions

Does Long Term Disability Cover Injuries From Labor and Birth?

Yes, long term disability (LTD) insurance typically covers injuries sustained during labor and birth. This includes both physical injuries, such as tearing or nerve damage, as well as mental health conditions, such as postpartum depression or anxiety. However, the extent and duration of coverage may vary depending on the specific policy and the circumstances of the injury.

It is important to note that LTD coverage typically only applies to injuries sustained while the individual is covered under the policy. If the injury occurs before the policy takes effect or after coverage ends, it may not be covered. Additionally, some policies may have specific exclusions or limitations for certain types of injuries, so it is important to review the policy carefully to understand what is covered.

What Types of Long Term Disability Insurance Policies Cover Injuries from Labor and Birth?

Most long term disability insurance policies will cover injuries from labor and birth. However, the extent and duration of coverage may vary depending on the specific policy. Some policies may offer more comprehensive coverage for maternity-related injuries, while others may have limitations or exclusions for certain types of injuries.

It is important to review the policy carefully to understand what is covered and what is not. Additionally, it may be helpful to speak with an insurance agent or representative to clarify any questions or concerns about coverage for labor and birth injuries.

What Are Some Common Labor and Birth Injuries Covered by Long Term Disability Insurance?

Common labor and birth injuries that may be covered by long term disability insurance include physical injuries such as tearing, nerve damage, or infections, as well as mental health conditions such as postpartum depression or anxiety. Additionally, complications during pregnancy or childbirth, such as preeclampsia or gestational diabetes, may also be covered.

It is important to note that the extent and duration of coverage may vary depending on the specific policy and the circumstances of the injury. Some policies may have specific exclusions or limitations for certain types of injuries, so it is important to review the policy carefully to understand what is covered.

What Documents Are Needed to Apply for Long Term Disability Coverage for Labor and Birth Injuries?

To apply for long term disability coverage for labor and birth injuries, you will typically need to provide documentation of the injury, as well as documentation of your medical treatment and any related expenses. This may include medical records, bills, and receipts.

Additionally, you may need to provide information about your employment and income, as well as any other insurance coverage you may have. It is important to review the policy carefully and speak with an insurance agent or representative to understand what documentation is required to apply for coverage.

How Can I Make Sure I am Covered for Labor and Birth Injuries Under My Long Term Disability Insurance Policy?

To ensure that you are covered for labor and birth injuries under your long term disability insurance policy, it is important to review the policy carefully and speak with an insurance agent or representative. Make sure to understand what types of injuries are covered, as well as any exclusions or limitations that may apply.

Additionally, it may be helpful to keep detailed records of any medical treatment or expenses related to labor and birth injuries. This can help ensure that you have the documentation you need to apply for coverage and can help support your claim if coverage is denied.

In conclusion, long term disability insurance can provide coverage for injuries sustained during labor and birth. It is important to carefully review the terms and conditions of your policy to ensure that you have adequate coverage for such situations. Speak with your insurance provider to learn more about the specific benefits and limitations of your policy.

It is also worth noting that long term disability insurance can provide financial security and peace of mind in the event of unexpected injuries or illnesses that prevent you from working. By having this coverage in place, you can focus on your recovery and get the support you need without worrying about the financial impact.

Overall, if you are planning to start a family or are currently pregnant, it is a good idea to consider long term disability insurance as part of your overall financial plan. It can provide valuable protection and help you feel more confident about your ability to manage unexpected challenges.

Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases from minor injuries to devastating accidents, earning him a sterling reputation as a trusted and passionate advocate for justice. Brenton's unwavering dedication to his clients has cemented his position as a sought-after personal injury attorney.

- Latest Posts by Brenton Armour

-

Can You Get A Misdiagnosis Cataracts?

- -

South Carolina Dog Bite Laws?

- -

Iowa Dog Bite Laws?

- All Posts