Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases...Read more

If you’re a driver in West Virginia, you may be wondering whether you need to have Personal Injury Protection (PIP) insurance. This is a type of insurance that covers medical expenses and lost wages in the event of an accident, regardless of who was at fault. In this article, we’ll take a closer look at the requirements for PIP insurance in West Virginia, as well as the benefits of having this type of coverage. So, let’s dive in and explore this important topic for motorists in the Mountain State.

Is Personal Injury Protection Required in West Virginia?

Understanding Personal Injury Protection (PIP)

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages after a car accident. In West Virginia, PIP coverage is optional, but it is highly recommended. PIP insurance provides protection to the driver and passengers in the vehicle, regardless of who caused the accident. It is a no-fault coverage that pays the expenses of the driver and passengers, regardless of who is at fault for the accident.

PIP insurance covers medical expenses, rehabilitation, and lost wages. It also covers funeral expenses and survivor benefits if someone is killed in a car accident. PIP insurance can be added to an existing car insurance policy, or it can be purchased as a separate policy.

Benefits of Personal Injury Protection (PIP)

Personal Injury Protection (PIP) insurance provides several benefits to drivers and passengers. The benefits include:

1. Medical Expenses: PIP insurance covers medical expenses related to a car accident, including hospital bills, doctor’s fees, surgery, and rehabilitation.

2. Lost Wages: PIP insurance covers lost wages if the driver or passengers are unable to work due to injuries sustained in a car accident.

3. Survivor Benefits: PIP insurance provides survivor benefits if someone is killed in a car accident. The benefits include funeral expenses and survivor benefits for the deceased’s family.

4. No-Fault Coverage: PIP insurance is a no-fault coverage that pays for the expenses of the driver and passengers, regardless of who is at fault for the accident.

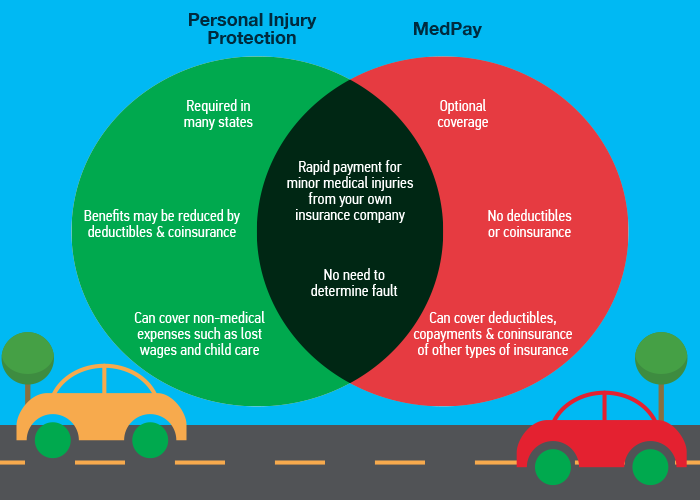

Personal Injury Protection (PIP) vs. Medical Payments (MedPay)

Personal Injury Protection (PIP) and Medical Payments (MedPay) are both types of car insurance that cover medical expenses after a car accident. However, there are some key differences between the two.

PIP insurance covers not only medical expenses but also lost wages, survivor benefits, and rehabilitation expenses. MedPay only covers medical expenses.

PIP insurance is a no-fault coverage, meaning it pays for the expenses of the driver and passengers, regardless of who is at fault for the accident. MedPay is a fault coverage, meaning it only pays for medical expenses if the driver is at fault for the accident.

In West Virginia, PIP insurance is optional, while MedPay is required. However, drivers can choose to waive MedPay coverage if they have PIP insurance.

How to Add Personal Injury Protection (PIP) Coverage

If you want to add Personal Injury Protection (PIP) coverage to your car insurance policy, you have a few options. You can:

1. Add it to your existing car insurance policy: Most car insurance companies offer PIP insurance as an add-on to their existing car insurance policies.

2. Purchase a separate policy: You can also purchase a separate PIP insurance policy from a car insurance company.

3. Check with your employer: Some employers offer PIP insurance as part of their employee benefits package.

Conclusion

In conclusion, Personal Injury Protection (PIP) insurance is not required in West Virginia, but it is highly recommended. PIP insurance provides several benefits to drivers and passengers, including medical expenses, lost wages, and survivor benefits. PIP insurance is a no-fault coverage that pays for the expenses of the driver and passengers, regardless of who is at fault for the accident. If you want to add PIP insurance to your car insurance policy, you can do so by adding it to your existing policy, purchasing a separate policy, or checking with your employer.

Contents

- Frequently Asked Questions

- What is Personal Injury Protection (PIP) insurance?

- Is Personal Injury Protection required in West Virginia?

- What are the benefits of Personal Injury Protection insurance?

- How much does Personal Injury Protection insurance cost in West Virginia?

- Can I use my health insurance instead of Personal Injury Protection insurance?

- Personal Injury Protection Car Insurance

- Can You Get A Misdiagnosis Cataracts?

- South Carolina Dog Bite Laws?

- Iowa Dog Bite Laws?

Frequently Asked Questions

Here are some common questions and answers about whether Personal Injury Protection is required in West Virginia.

What is Personal Injury Protection (PIP) insurance?

Personal Injury Protection (PIP) insurance is a type of car insurance that covers medical expenses and other related costs if you or your passengers are injured in a car accident. PIP insurance can also cover lost wages and other expenses related to the accident.

In West Virginia, PIP insurance is optional, but it is recommended that drivers consider purchasing it to protect themselves and their passengers in the event of an accident.

Is Personal Injury Protection required in West Virginia?

No, Personal Injury Protection (PIP) insurance is not required in West Virginia. However, drivers must have liability insurance that covers bodily injury and property damage. Liability insurance does not cover medical expenses and other related costs that PIP insurance can cover.

While PIP insurance is not required, it is recommended that drivers consider purchasing it to provide additional protection in the event of an accident.

What are the benefits of Personal Injury Protection insurance?

The benefits of Personal Injury Protection (PIP) insurance include coverage for medical expenses, lost wages, and other expenses related to an accident. PIP insurance can also provide coverage for passengers in your vehicle who are injured in an accident, regardless of who is at fault.

PIP insurance can help you and your passengers get the medical care you need without worrying about the cost. It can also provide financial support if you are unable to work due to injuries sustained in an accident.

How much does Personal Injury Protection insurance cost in West Virginia?

The cost of Personal Injury Protection (PIP) insurance can vary depending on several factors, including your driving record, age, and the amount of coverage you choose. It is recommended that you compare quotes from different insurance providers to find the best coverage at a price that fits your budget.

While PIP insurance is not required in West Virginia, it can provide valuable protection in the event of an accident. The cost of PIP insurance may be worth the peace of mind that comes with knowing you and your passengers are covered.

Can I use my health insurance instead of Personal Injury Protection insurance?

If you are injured in a car accident, your health insurance may cover some of your medical expenses. However, health insurance may not cover all of the costs associated with an accident, such as lost wages and other related expenses.

Personal Injury Protection (PIP) insurance is designed specifically to cover the costs associated with car accidents, including medical expenses, lost wages, and other related expenses. While PIP insurance is not required in West Virginia, it can provide valuable protection in the event of an accident.

Personal Injury Protection Car Insurance

In conclusion, Personal Injury Protection (PIP) is required in West Virginia. This type of insurance coverage provides essential benefits that can help protect you and your loved ones in the event of an accident. PIP insurance covers medical expenses, lost wages, and other related costs that may arise from a car accident.

While it may seem like an unnecessary expense, PIP insurance can provide peace of mind and financial security in the event of an accident. It can also help ensure that you receive the care you need without worrying about the cost.

If you are a driver in West Virginia, it is important to understand your insurance requirements and consider adding PIP coverage to your policy. By doing so, you can help protect yourself and your loved ones from the financial burden that can come with a car accident.

Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases from minor injuries to devastating accidents, earning him a sterling reputation as a trusted and passionate advocate for justice. Brenton's unwavering dedication to his clients has cemented his position as a sought-after personal injury attorney.

- Latest Posts by Brenton Armour

-

Can You Get A Misdiagnosis Cataracts?

- -

South Carolina Dog Bite Laws?

- -

Iowa Dog Bite Laws?

- All Posts