Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases...Read more

If you’ve recently received a personal injury settlement, you may be wondering if it counts as income. After all, you didn’t work for it, so does it still need to be reported on your taxes? The answer isn’t always straightforward, but understanding the basics can help you navigate this potentially confusing situation. In this article, we’ll explore the ins and outs of personal injury settlements and whether or not they are considered income for tax purposes. So, let’s dive in and get started!

A personal injury settlement is usually not considered as income for tax purposes, as it is not earned income. However, if you receive punitive damages or interest on the settlement, those amounts may be taxable. It is best to consult a tax professional to understand the tax implications of your specific settlement.

Contents

- Is a Personal Injury Settlement Considered Income?

- Frequently Asked Questions

- 1) Is a personal injury settlement considered income?

- 2) Do I need to report my personal injury settlement on my tax return?

- 3) What if my personal injury settlement is for lost wages?

- 4) Can I deduct my medical expenses from my personal injury settlement?

- 5) What if I receive a structured settlement?

- Is My Injury Settlement Taxable

- Can You Get A Misdiagnosis Cataracts?

- South Carolina Dog Bite Laws?

- Iowa Dog Bite Laws?

Is a Personal Injury Settlement Considered Income?

If you have been injured in an accident, you may be entitled to a personal injury settlement. This settlement is meant to compensate you for your injuries and any financial losses you have suffered as a result of the accident. However, many people wonder whether a personal injury settlement is considered income for tax purposes. In this article, we will answer this question and provide you with all the information you need to know about personal injury settlements and taxes.

What is a Personal Injury Settlement?

A personal injury settlement is a payment made to an individual who has been injured as a result of someone else’s negligence. This payment is meant to compensate the individual for their injuries and any financial losses they have suffered as a result of the accident. Personal injury settlements can be reached through negotiations with the responsible party, or through a court judgment.

Benefits of a Personal Injury Settlement

A personal injury settlement can provide a number of benefits to the injured party. These benefits include:

- Compensation for medical expenses

- Compensation for lost wages

- Compensation for pain and suffering

- Peace of mind

Personal Injury Settlement Vs. Court Judgment

While personal injury settlements can be reached through negotiations with the responsible party, they can also be awarded through a court judgment. A court judgment is a decision made by a judge after a trial. In this case, the judge will determine the amount of compensation the injured party is entitled to based on the evidence presented in court.

Is a Personal Injury Settlement Considered Income?

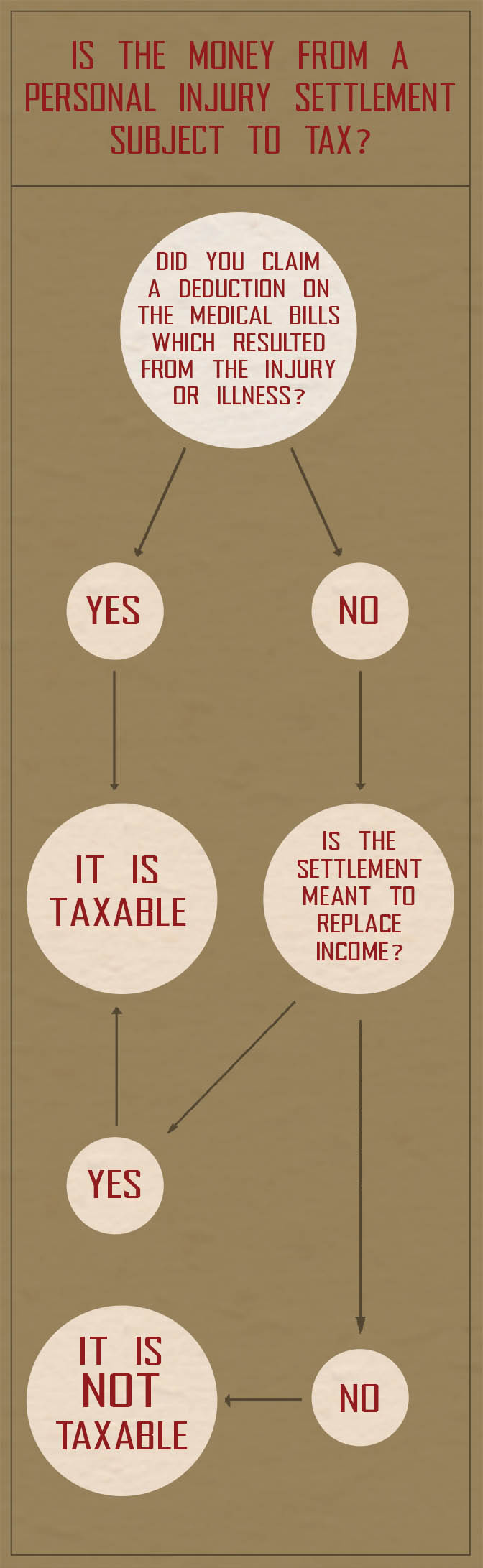

The answer to this question is: it depends. In general, personal injury settlements are not considered income for tax purposes. This means that you do not have to pay taxes on the settlement amount. However, there are some exceptions to this rule.

Exceptions to the Rule

There are some situations in which a personal injury settlement may be considered income for tax purposes. These situations include:

- If the settlement includes punitive damages

- If the settlement includes interest

- If the settlement is for lost wages or lost profits

- If the settlement is for emotional distress

Taxable Portion of a Personal Injury Settlement

If your personal injury settlement includes any of the above exceptions, the taxable portion of the settlement will depend on the specific circumstances of your case. In general, the portion of the settlement that is considered taxable will be the amount that is meant to compensate you for lost wages, lost profits, or emotional distress.

Reporting a Personal Injury Settlement

If your personal injury settlement is considered taxable, you will need to report it on your tax return. You may also need to pay taxes on the settlement amount. However, if your settlement is not considered taxable, you do not need to report it on your tax return.

Conclusion

In general, personal injury settlements are not considered income for tax purposes. However, there are some exceptions to this rule. If your settlement includes punitive damages, interest, lost wages or profits, or compensation for emotional distress, you may be required to pay taxes on the settlement amount. If you are unsure whether your settlement is considered taxable, it is best to consult with a tax professional.

Frequently Asked Questions

Personal injury settlements are common in cases where someone is injured due to someone else’s negligence. Many people wonder if they need to pay taxes on the money they receive from a personal injury settlement. Here are 5 common questions and answers about whether a personal injury settlement is considered income.

1) Is a personal injury settlement considered income?

A personal injury settlement is typically not considered income for tax purposes. This is because the money awarded in a settlement is intended to compensate the injured person for their losses, such as medical bills, lost wages, and pain and suffering. These types of damages are not considered income by the IRS.

However, if the settlement includes punitive damages or interest, those amounts may be taxable. Punitive damages are meant to punish the defendant for their actions, and interest is earned on the settlement amount. If your settlement includes these types of damages, it’s best to consult a tax professional to determine if they are taxable.

2) Do I need to report my personal injury settlement on my tax return?

If your personal injury settlement is not considered income, you do not need to report it on your tax return. However, if you received a 1099-MISC form from the defendant or their insurance company, you may need to report the settlement on your tax return. This is because the 1099-MISC form is used to report income that is not subject to withholding, such as a settlement payment.

If you’re not sure whether you need to report your settlement on your tax return, consult a tax professional or the IRS website for guidance.

3) What if my personal injury settlement is for lost wages?

If your personal injury settlement is for lost wages, the portion that replaces your income is considered taxable income. This is because the money is replacing the income you would have earned if you were not injured. However, any portion of the settlement that is intended to compensate you for medical expenses or pain and suffering is not considered taxable income.

It’s important to keep good records of your settlement to determine which portions are taxable and which are not. If you’re not sure, consult a tax professional for guidance.

4) Can I deduct my medical expenses from my personal injury settlement?

If your personal injury settlement is for medical expenses, you cannot deduct those expenses from your taxes. This is because the settlement is intended to compensate you for those expenses, so you cannot claim them as a deduction as well. However, if your settlement is for lost wages, you may be able to deduct your medical expenses as an itemized deduction on your tax return.

Again, keeping good records of your settlement and expenses is important to determine which deductions you’re eligible for. If you’re not sure, consult a tax professional for guidance.

5) What if I receive a structured settlement?

A structured settlement is a type of settlement where the payment is made over time, rather than in a lump sum. If you receive a structured settlement, the tax treatment depends on the type of damages the settlement is for.

If the settlement is for personal physical injuries or physical sickness, the payments are generally not taxable. However, if the settlement is for other types of damages, such as lost wages or emotional distress, the tax treatment may be different. Consult a tax professional for guidance on how to report a structured settlement on your tax return.

Is My Injury Settlement Taxable

In conclusion, whether a personal injury settlement is considered income or not depends on several factors. These factors may include the type of settlement, the nature of the injury, and the purpose of the settlement. It is important to seek legal advice from a qualified attorney to help you understand the tax implications of your settlement.

It is worth noting that some personal injury settlements may be taxable while others may not. If your settlement includes compensation for lost wages, emotional distress, or punitive damages, it may be considered taxable income. However, if your settlement is meant to cover medical expenses, it may not be taxable.

In summary, determining whether a personal injury settlement is considered income or not can be a complex issue. It is best to consult with a legal professional to ensure you understand the tax implications of your settlement and avoid any potential legal issues down the line.

Brenton Armour, the visionary founder and lead attorney at InjuryLawsuitHelper, boasts an impressive 15-year track record in personal injury law. His remarkable expertise spans cases from minor injuries to devastating accidents, earning him a sterling reputation as a trusted and passionate advocate for justice. Brenton's unwavering dedication to his clients has cemented his position as a sought-after personal injury attorney.

- Latest Posts by Brenton Armour

-

Can You Get A Misdiagnosis Cataracts?

- -

South Carolina Dog Bite Laws?

- -

Iowa Dog Bite Laws?

- All Posts